Keppel share price has been badly battered down lately. The share price need a boost and it came from a news from Keppel’s CEO last night, that billions of dollars of assets could potentially be monetized over coming years.

Source: CNA excerpts: “SINGAPORE: Singaporean conglomerate Keppel Corp said on Tuesday (Sep 29) it had identified assets worth S$17.5 billion that could potentially be monetised, including through sales, and started a review of its loss making offshore and marine (O&M) business.

The plans unveiled on Tuesday are part of Keppel’s 10-year strategy that it had flagged earlier this year to refocus its portfolio to energy and environment, urban development, connectivity and asset management. Keppel said it was exploring options including strategic mergers and disposals for its offshore and marine business, which builds oil rigs and has been battered by falling energy prices.”

My thoughts below…

Disclaimer: Please note that the below post comprises solely of my own opinions and does not represent in anyway concrete information or comments from the company or from the press. I cannot guarantee the accuracy of the information contained herein, and it shall be intended to be used and must be used for informational purposes only. Please refer to the disclaimer tab of this website for more information.

O&M BUSINESSES

Keppel also states that they are exploring both organic and inorganic options for the strategic review of their O&M business (KOM). Organic options include reviewing the strategy and business model of Keppel O&M, assessing its current capacity and global network of yards and restructuring to seek opportunities as a developer of renewable energy assets; while inorganic options would range from strategic mergers to disposal.

INORGANIC : Strategic Mergers or Disposal

The fastest way to monetise is of course inorganic. i.e. mergers and/or disposals. Obvious option will be to merge with SCM. However why did Keppel also need to consider option of disposal O&M business?

The simple reason is because it is not as easy to consolidate two major players within a particular segment, just like what “layman investor” think as a snap of finger “Ok.. let’s merge and unlock value for investors and business will prosper”. It is not as straight forward and there are many pros and cons or barriers to KOM-SCM merger.

Read my earlier articles :

Will Keppel Offshore & Marine and Sembcorp Marine Merge?

While most of us are just thinking about merger with SCM, but there are always other options. For instance KOM can be taken private and solely owned by Temasek, or together with some other strategic funds or companies. Or perhaps merge with other Temasek-owned O&G company such as Pavilion Energy that is focused on LNG and having synergy with Keppel’s O&M business. Anyway KOM’s major order backlog today are in gas related solutions.

Otherwise, there are also possibility of selling KOM businesses in parts if not wholly, such as disposal of Rig business, Floatel business, FPSO business, Marine business, Renewable business, Proprietary Designs, Repairs business, Defunct KrisEnergy? etc.

Keppel can also consider to dispose some rigs they owned via “sale and leaseback “deals. This means Keppel selling the rigs to a “fund/company” and then lease it back long term on day/month/year rate at a percentage of interest higher than the selling price. However this is only possible if they manage to find a long term charter for the rigs, or making partnerships with Oil Companies and/or Rig Contractors. Current environment of low oil is tough to find long term charter for Rigs, but within the next few years if situation improves, there can be higher possibility.

The same “sale and leaseback” can also apply to O&M yards they owned, although Keppel mentioned the unlock of 17.5B does not include the O&M yards that are considered as fixed assets.

ORGANIC : Developer of Renewable Assets

Renewables mainly means Wind, Solar or Hydro. And from the top of my head, I guess it is mainly Wind and Solar businesses.

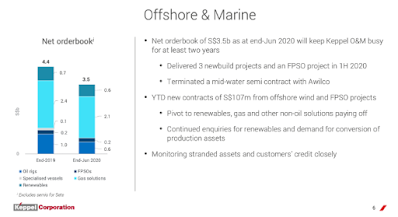

If we look at Keppel’s latest 1H2020 presentation (refer here), net order book for O&M is S$3.5B, and bulk of it comes from Gas solutions comprising of 2.1B, while renewable backlog is a mere 0.6B. Hence pure organic growth by wining orders is not going to be easy.

Therefore, when Keppel said to be a developer of renewable assets, I think they probably mean options of taking ownerships wholly or partly via strategic partnerships of Offshore Wind Farms or Solar Farms and developing it into a viable income generating assets, rather than wining EPC contracts for Renewables.

Source: Keppel’s 1H2020 Financial Results 30 July 2020

For example in Offshore Wind, you have Danish MNC giant Orsted being the world’s largest developer of wind energy accounting for close to 30% of the global installed capacity in wind energy, investing into Wind Energy in Taiwan now. At the moment, Offshore Wind especially in Taiwan, Vietnam, Japan, Korea, and North Sea region are hot spots of potential projects in near future, as governments and authorities are hungered for more clean energy.

For Solar, you can look at businesses such as India’s Adani Green Energy Limited (AGEL) that Keppel may try to emulate. The company operates Kamuthi Solar Power Project, one of the largest solar photovoltaic plants in the world. AGEL also won the world largest solar project amounted to USD6B by Solar Energy Corporation of India to build a 8000 MW photovoltaic power plant. Another company in the Solar business space is GCL New Energy HQ in China but listed in HK.

That said, developer of Renewable Assets is long term business and requires a lots of upfront investments and developers will also face complexity in dealing with governments of countries where the Assets are.

NON O&M BUSINESSES

Aside from O&M, Keppel other range of business are from telecommunications to property development with assets to be monetised over the next few years. These assets include the group’s landbank which is held at historical cost, development projects, investment properties, assets being developed and stabilised for monetisation through Keppel-managed or third party platforms, various funds and investments etc.

One disposal candidate is likely to be M1 that Keppel and SPH co-owned, and was taken private in 2019 valued at S$1.9 billion back then.

FINAL THOUGHTS

If you look at KEPPEL 2030 VISION (slides here), it is clear that the company want to be asset light and they have clear focus of recurring income.

The current O&M businesses revolves around Rig and shipbuilding contracts that are normally one-time businesses and are very competitive. Guess this is definitely not part of their 2030 vision. I think Keppel will be looking to gradually scale down or divest this part of the businesses, which they already did after the oil crisis.

The new Energy business model that Keppel is targeting is likely to be one that can provides recurring income stream, stemming from ownerships of Energy / Renewable assets that produces oil and gas or generate energy (i.e. GW).

In the process, KOM will also have the business units (BU) or expertise to support the developments of these assets. They will probably keep other asset lighter O&M businesses with higher margins, such as repairs and conversions, or selling of offshore equipment, if they are not going to divest the entire O&M businesses.

The inter-BU cross selling is also part of the 2030 vision with common support and share services that have very little overlapping, optimising the business.

Keppel’s vision is very much investment driven. This is not surprising at all, considering their current CEO comes with a GIC and investment background.

I am a shareholder of Keppel at the time of writing. If you ask me if Keppel will be successful going forward and bring more shareholder value, my answer is likely to be yes! If you then ask me, is Keppel share price cheap now? My answer is yes again.

So will I buy more? Then you need to ask yourself if there are other cheaper and more attractive shares?

*Smiles*.

OTHER RELATD ARTICLES

Rolf’s Thoughts: Keppel (the son), Hoping for Temasek (the father) ‘s Partial Offer?

Will Keppel Corp and DBS support the defunct KrisEnergy’s fund raising?

Keppel Corp – How Much Do You Know About Her O&M Businesses?

The tough question is who would wanna buy their O&G assests when O&G is going downhill. My 2 cents

In SG, most big companies always look to Temasek… hahhahaa… not sure good or bad!

Anyway, it is generally more difficult now, but no totally impossible. O&G is cyclical, and I will explain more in a separate post.

Keppel cuts losses on O&M and recovers whatever left on the table instead of dragging on with rotting biz? Some money back is still better.

Keppel like SG are not good in growing businesses outside financial services and investment companies.

SG companies are only good in growing when times is good, but when times are tough, we start complaining. But perhaps it is because of our lack of anticipation and always thinking good times will last forever.

That is Keppel and SG and most Singaporeans!

There are many private owned O&M companies who are still sustaining well for 30, 40 years, I known of. The biz is cyclical. Now is a bad time without doubt! But to blame the environment entirely is not fair for companies operating in the environment for years who knows the biz is cyclical!

Just last year, will we say Aerospace is rotting biz?

Again, in my next post, I will show many of you why the company is to be blamed and not always the environment! There are many private owned companies in the world that are still sustaining and earn sufficient money averaged over the past 10,15,20 years, because the owner knows the business is cyclical and during good times are not growing that aggressively.