ABOUT RAY DALIO

Ray Dalio is one of the richest investors in the world with close to USD20B of net worth. He founded Bridgewater Associate in 1975, which today is the largest Hedge funds in the world with USD160B AUM.

As a person, he is full of humility and respect to human beings regardless of social status. He is also a family man with his wife married since 1976 with four sons who are all successful in their own ways but low profile. The Dalio family has no scandalous news reported against them despite their limelight. Ray Dalio is also a philanthropist joining Bill Gates and Warren Buffet’s Giving Pledge, declaring to donate more than half of his fortune to charity within his lifetime.

He is an advocate of “radical transparency and truth” and believe that in order to be happy and truly successful in life, you need to find meaningful work and meaningful relationships in life.

Ray Dalio is my favourite investor. I read his principles, watched countless of his interviews. To me, he is undoubtedly the most complete investor. He’s life ticks in all my the 5 boxes of my H2F3 (Health, Family, Finance, Friends, Hobbies) philosophy. Read:

Rolf’s Updates – My Priorities in Life – Health, Finance, Family, Friends & Hobbies – 2020 1Q

All WEATHER PORTFOLIO

Ray Dalio attributes his success in investment to the way he construct his investment portfolio. He believes that there are four seasons that a global economy will go through.

· Period of High inflation – prices go up and purchasing power comes down.

· Period of Deflation – prices decrease or do not increase as quickly as expected

· Period of Improving economic growth

· Period of Declining economic growth

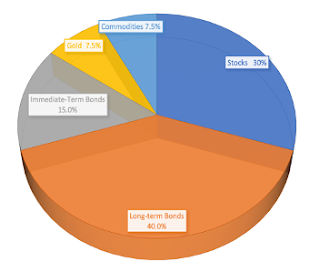

A portfolio that is “all weather” can give sustainable returns regardless of the seasons described earlier. A typical example of all-weather portfolio is as below, and the “Holy Grail” of it, is Diversification. Dalio also suggest that we rebalance the portfolio each year. Below example of diversification.

A replica example of it can be as follows:

PS: The above chart and table is not a direct advice, and please do your own due diligence

Diversification includes protecting returns having assets in different classes, with a mix of cash, stocks, bonds, gold, commodities etc. And within the stocks allocation, there must be further diversification which is explained in the following article later. If your risk appetite is higher, then you can increase your equity allocation percentage which potentially can give you higher returns. On the contrary, if you are risk-adverse, then increase your bond and cash holdings, but safer asset classes typically is unable to generate the sort of income that stocks do. At the same time, there must be geographical diversification. Refer here for more info.

Returns

For information, Bridgewater all-weather fund has returned 7.8% p.a. average since inception in 1996. And last year it gained 16.6%. And another of Bridgewater’s fund, Pure Alpha fund famously return 9.5% in 2008 during the financial crisis while the S&P500 lost 37%. But the fund outperformed the markets to a lesser degree in 2018. Alpha net annualise returns is 11.1% since inception close to 30 years ago. Pure Alpha funds are closed to new investors and there is a long waiting list to get in.

HOLY GRAIL OF INVESTING – DIVERSIFICATION WITH NO CORRELATION

Basically Ray’s Holy Grail of investing concept means highest returns with lowest risks! Wow… this is attractive! While the concept is easy to understand the actual construction of an optimised portfolio is not as simple as it is. This concept is written in his book “Principles For Success” .

Extracted from his book, Ray states:

With 15-20 good, uncorrelated return streams, you can dramatically reduce your risks without reducing your expected returns.

Dalio singled out that many has misunderstood the true meaning of diversification. People tend to choose different assets, but still within the same class, believing this is enough to protect their portfolios.

For example, you can choose a Bank stock, and at the same time you choose an Insurance company stock or Credit card company stock, which essentially are in the same class. They have high correlation. A comparative lower but still has high correlation example is a real estate stock with a bank stock, because real estate’s decline will typically affects bank’s earnings since the bank made significant amount of loans to real estate companies.

Dalio also states: Individual assets within an asset class are usually about 60% correlated with each other, so even if you think you’re diversified, you’re not.

Ray Dalio’s recommendation is making a handful of good uncorrelated best that are balanced and leveraged well is the surest way of having a lot of upside without being exposed to unacceptable downside.

EXAMPLE OF INVESTMENT WITH NO CORRELATION

Case 1, High Correlation : 4 bank stocks

Case 2, Medium Correlation : 2 bank stocks, 1 insurance and 1 credit card stock

Case 3, Low Correlation: Bank, Energy, Real Estate, Car Company

Case 4, Zero Correlation: Outer Space, Fastfood, E-Commerce, Real Estate

Refer to below video and all credits to Jack Chapple – the youtuber.

What is your views on Ray Dalio’s investment concepts?

If you are interested in other articles of Ray Dalio within my blog, please refer to below:

Hello everyone, Are you into trading or just wish to give it a try, please becareful on the platform you choose to invest on and the manager you choose to manage your account because that’s where failure starts from be wise. After reading so much comment i had to give trading tips a try, I have to come to the conclusion that binary options pays massively but the masses has refused to show us the right way to earn That’s why I have to give trading tips the accolades because they have been so helpful to traders . For a free masterclass strategy kindly contact ([email protected]) for a free masterclass strategy. He'll give you a free tutors on how you can earn and recover your losses in trading for free..

I'm happy to see the considerable subtle element here!. investing

Natural herbs have cured so many illness that drugs and injection can’t cure. I've seen the great importance of natural herbs and the wonderful work they have done in people's lives. i read people's testimonies online on how they were cured of HERPES, HIV, diabetics etc by Dr Edes herbal medicine, so i decided to contact the doctor because i know nature has the power to heal anything. I was diagnosed with Herpes for the past 3 years but Dr Edes cured me with his herbs and i referred my aunt and her husband to him immediately because they were both suffering from Herpes but to God be the glory, they were cured too .I know is hard to believe but am a living testimony. There is no harm trying herbs, Thanks. Write him on WhatsApp on +2348151937428. @dr_edes_remedies deals with

(1)Alzheimer virus

(2)Cancer

(3)HIV

(4)Herpes

(5)Genital warts

(6)ALS

(7)Virginal infection

(8)HPV

(9)Hepatitis

(10)Asthma

Email him on [email protected]

https://dredesherbalhome.weebly.com