Over the

last month, I had been pretty tame in terms of stocks action partly due to my

newborn and the market volatility. Now, New

Year, New Hopes! In

particular, with the low valuation of O&G stocks in Singapore, I am hawkish.

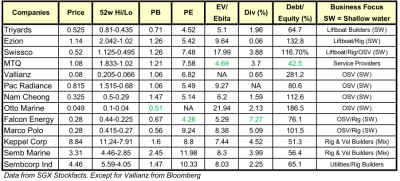

Let’s review some of the interesting companies in the watchlist below.

last month, I had been pretty tame in terms of stocks action partly due to my

newborn and the market volatility. Now, New

Year, New Hopes! In

particular, with the low valuation of O&G stocks in Singapore, I am hawkish.

Let’s review some of the interesting companies in the watchlist below.

Watchlist

Oil

Price 5 ½ year low

Price 5 ½ year low

Oil price ends

2014 on a 5 ½ year low. Brent and Crude at US$57 and US$53 a barrel

respectively i.e. 45% decline since a year ago. According

to Business Times few days back, Market cap of 23 O&M firms listed on SGX fell 15.7% (S$5.77b)

over period from Nov 4 to Dec 4. To provide some assistance in your selection from above table, below are extract of views from the industry people interviewed by Business Times.

2014 on a 5 ½ year low. Brent and Crude at US$57 and US$53 a barrel

respectively i.e. 45% decline since a year ago. According

to Business Times few days back, Market cap of 23 O&M firms listed on SGX fell 15.7% (S$5.77b)

over period from Nov 4 to Dec 4. To provide some assistance in your selection from above table, below are extract of views from the industry people interviewed by Business Times.

Opportunities

Look out

for Companies with Superior Business Models

for Companies with Superior Business Models

“The scenario of low valuations will not only

present attractive opportunities for the stronger companies to acquire assets,

it could allow diligent investors who can identify O&M companies with

superior business models to ride out this down cycle, to have an opportunity to

acquire shares at relatively cheap valuations” – Darren Yeo, Vallianz CEO

present attractive opportunities for the stronger companies to acquire assets,

it could allow diligent investors who can identify O&M companies with

superior business models to ride out this down cycle, to have an opportunity to

acquire shares at relatively cheap valuations” – Darren Yeo, Vallianz CEO

Look out

for those with NOC as End Customers

for those with NOC as End Customers

“A lot depends on who the O&M companies do

business with. International Oil Companies (IOCs) tend to be more profit-oriented, some of them have already

announced cuts in their capital expenditure in 2015. However these cuts relate

mainly to exploration activities. Other the other hand, National Oil Companies (NOCs) generally have

relatively stable expenditures for their E&P activities. Although they may

take the opportunity to pare costs, we believe it will be “business as usual”

for these NOCs.” – Darren Yeo, Vallianz CEO

business with. International Oil Companies (IOCs) tend to be more profit-oriented, some of them have already

announced cuts in their capital expenditure in 2015. However these cuts relate

mainly to exploration activities. Other the other hand, National Oil Companies (NOCs) generally have

relatively stable expenditures for their E&P activities. Although they may

take the opportunity to pare costs, we believe it will be “business as usual”

for these NOCs.” – Darren Yeo, Vallianz CEO

Oil

Price recovery by 2nd Half 2015

Price recovery by 2nd Half 2015

“We are expecting crude oil prices to begin stabilizing

in the first half of 2015 followed by a recovery in the second half of 2015. We

anticipate that demand for oil next year will be fuelled by accelerating growth

in the economies of the USA, Japan, the UK and certain regions of Europe.”

in the first half of 2015 followed by a recovery in the second half of 2015. We

anticipate that demand for oil next year will be fuelled by accelerating growth

in the economies of the USA, Japan, the UK and certain regions of Europe.”

Possibilities

of Takeovers and Consolidation

of Takeovers and Consolidation

“Low

valuation of of O&M companies could lead to takeovers, privatizations or

share buy-backs” – Deputy CEO Miclyn (former CEO Jaya) Venka Shesh.

valuation of of O&M companies could lead to takeovers, privatizations or

share buy-backs” – Deputy CEO Miclyn (former CEO Jaya) Venka Shesh.

Risks

Oil

Price Correction

Price Correction

“Risks for

the sector in 2015 are more tilted to the downside with oil price correction.

For one, any further oil price volatility would affect the rates at which the

projects are being awarded, compounded by the renewed focus by IOC on shorter

term shareholders’ returns.”

the sector in 2015 are more tilted to the downside with oil price correction.

For one, any further oil price volatility would affect the rates at which the

projects are being awarded, compounded by the renewed focus by IOC on shorter

term shareholders’ returns.”

Credit

Crunch and Fund Raising Problems

Crunch and Fund Raising Problems

“The sector

faced possibility of credit crunch should short-term outlook deteriorate.” – Ms Low Pei Han, Investment analyst at OCBC Investment Research

faced possibility of credit crunch should short-term outlook deteriorate.” – Ms Low Pei Han, Investment analyst at OCBC Investment Research

“Since the

valuations of O&M companies have already declined quite drastically in the

last 3-4 months, this is likely to make it challenging for O&M companies to

raise funds in 2015.” – Darren Yeo, Vallianz CEO

valuations of O&M companies have already declined quite drastically in the

last 3-4 months, this is likely to make it challenging for O&M companies to

raise funds in 2015.” – Darren Yeo, Vallianz CEO

Who Will Suffer

- Companies

highly indebted with weak balance sheet - Companies

with exploration, development and deep-water projects. - Shale

independent producers - Deep-water

rig owners, seismic survey service providers, large PSV operators and

infrastructure fabrication/installation companies. - Shipyards

facing possibility of default and cancellations and low order intake

Who Will Survive

- Companies

with strong balance sheet - Companies

with superior business model - Companies

with NOC as clients - Companies

operating at shallow water fields operated in Middle East remain economical due

to lower break-even costs

Rolf’s View

DYODD! This

is a powerful word I learnt recently. Hahaha. It refers to Do Your Own Due Diligence. Probability

is not certainty!

is a powerful word I learnt recently. Hahaha. It refers to Do Your Own Due Diligence. Probability

is not certainty!

Related

Posts:

Posts:

🙂

Hi CW,

🙂 at DYODD? Powderful right?

Hi Rolf,

Thanks for the great post on O&M 😉 I'm very keen to accumulate more SembCorp Ind.

Hi Boon Chin,

You r welcome! Which means SCI must drop or current valuation ok?

I already accumulated earlier but lousy price at 4.7 ave. Sad. haha!

Hi Rolf,

I first entered at $4.6, and accumulated at $4.15. Was ready for $3.9 but obviously no luck yet … I might nibble more shall price drop below $4.15 again 😉

Saw on news US weather pattern shifts dramatically colder, could oil price rebound due to this cold weather?

Hi Boon Chin,

Ok let's "nipple" together. LOL

Yes, it's true, normally winter time oil price will go up. But I read and wrote, oil price went down instead and is all time low now.

Market emotions empowerment is so strong. So really do not know what till happen next. Fingers cross!

Hi Rolf,

WTI and Brent are hovering around $46~$46, is this the time to "nipple" together? 😉

By the way, is Malaysia listed SapuraKencana Petroleum within your radar?

Thanks!

Hi Boon Chin,

Sorry for late reply as I was traveling in a country with no access to blog.

I am still a firm believer that oil price bound to rebound. It is a commodity that is scarce and shale is not sustainable…

But like many say…when? I do not know! Maybe as long as u continue to believe with reasons convincing to u; stick to ur belief; use non-urgent money to invest; do not loose sleep; do not find scapegoat; DYODD….then pls continue.

SapuraKencana not in my radar…but maybe good to know that they have E&P, Tender rigs, EPIC, PLSV, OSV businesses and their dependence on various NOCs, IOCs and how each segment of business drains or provides free cash flow, profitability, risks etc

Except for the Blue Chips and MTQ, the rest seems highly leveraged.

Hi Lizardo,

You are absolutely right. As I mentioned in my previous blog, O&G & Energy stocks are highly cyclical and contain higher risk than staples, defensive. It is also a high capital intensive sector, which requires continual re-investments for growth. This is why it explains the high risk. If you scan across the whole industry, you can hardly find company with superior business model not having leverage.

I have not included Ezra and Swiber, which you will fell off your chairs. I also have not included those energy E&P companies KrisEnergy, Loyz, Ramba, Mirach, RH Petrogras etc that not only have huge debts but no income per se. Note Keppel has a major stake in KrisEnergy!

1.Before dabble in O&G, you have to understand the sector and have the mindset that it is risky. Read my earlier blog to explain more about the sector to start with. https://rolfsuey.com/2014/03/oil-and-gas-stocks-in-singapore.html

2.Risk is personal as what fool.sg put it here superbly. What appear risky to one may not be to another. Read http://www.fool.sg/2014/12/23/1-important-risk-about-oil-and-gas-stocks-you-need-to-note/

Obviously for layman, they will think that MTQ is much better, because it is in the same industry but lower debt. For what it seems true, we must understand MTQ business nature. They are not as capital intensive than the rest because they are primarily in services business. Note in my table above, that their business segment is different. Also note downside of MTQ….low trading volume.

Blue chips (exclude SMM) are different because they include other segments outside O&G.

So if you are interested in O&G stocks, remember to understand the sector and understand that risk is personal.

Just my two cents thought. Mostly informative and not advocating. Remember the powerful word DYODD! Haha

Wish you a happy year ahead.

Hi Rolf,

Great post there regarding the oil and gas stocks. Lets hope Sembcorp Industries will do well 🙂

Hi Secretinvestors,

Mix feelings for SCI. If they drop a lot in the short term, will you be happy or sad?

By the way, SCI Marine segment is facing high competition in China and Korea. In China rigs are much cheaply built and already good quality.

Read https://rolfsuey.com/2014/07/keppel-and-sembcorp-marine-hit-by-slow.html

In Korea, they build FPSO, while Singapore yards still lag behind in this segment. Singapore yard converts FPSO and not build. Lower revenue, but good margin.

Semb marine & Kep strategy now focus from rig / vessel owners to high end IOC clients for bigger projects in FLNG, big scale conversion and mega repairs for VLCC. Semb marine is shifting to mega Tuas yard in 1.5-2.5 years’ where they can achieve mega projects.

hi Rolf,

oil crisis seem become worse, how do you think ? an opportunity or a disaster?

well, i have both semb marine and semb ind. serious, i do not really understand much about semb marine and semb ind, i invested mostly because i saw both of them dropped quite a lot from last year price.

well, low can be lower:)

Don't worry. Quite number of investment bloggers in semb ind. Won't feel the pain alone.

🙂

“人生不会苦一辈子,但一定会苦一阵子,如果你逃避苦这一阵子,就一定会苦一辈子

Maybe same with some stocks/ biz… Who had strong mgmt, superior biz, n strong bal sheet…

I think can be more worst… Oil price 30-40, Haha… Just remember before u invest, what is your threshold of pain…

I seriously do no know how price will move in short term…

🙂

“人生不会苦一辈子,但一定会苦一阵子,如果你逃避苦这一阵子,就一定会苦一辈子

the above sentence sound very chim to me.

what i interpret from the sentences, sound to me. if you invest, you may suffer temporary paper loss. if you do not invest, you will lose out more?

probably this is another interpretation from the above sentence. hahahah:)

Always remember that temporary paper losses may turn into permanent losses i.e. de-listed.

hahaha, semb corp and semb marine. not too worry about delist.

most probably my marco polo and PEC.

PEC has low debt, marco polo too high gearing.

Hi Yeh,

Haha sounds scary! I am optimist and it always work for me. Maybe not so bad!

Believe in urself! I do not think Marco Polo will be gone becos oil price drop.

They are in shallow water which only requires 20-30 a barrel to break even. I am in the industry, they still have money! If they r broke, I tell u!!!

PEC had been around for so long family biz not so easy. I seen how co with long track records weather more difficult crisis n more difficult times!

They r not like Lion Gold n Blumont….

Having said that. I should always be pessimistic to reader. A pessimistic blogger when co go down will say… Neh… I told n warn u before!!! U never listen. For optimistic blogger, on the contrary, If co price goes up, there will be silence!

End of the day, select stock base on your own judgement n not others. The most Powderful word DYODD! LOL

Quote: "Having said that. I should always be pessimistic to reader. A pessimistic blogger when co go down will say… Neh… I told n warn u before!!! U never listen. For optimistic blogger, on the contrary, If co price goes up, there will be silence! "

Wah! You are smart blogger with no inflated ego.

Say bad but turn good. No readers will scold you.

Say good but turn bad. May get hell from nasty readers.

LOL!

ok Rolf,

thanks wow. remember to update me about PEC and marco polo.

i am interested to buy keppel corp. how do you think?

too much oil and gas exposure?

Hi CW,

I am corporate man. Always be conservative, manage company and your boss expectations! Haha.

Hi Yeh,

For Keppel Corp and Semb Corp, Ask the Master CW….. close to rounds 100 already…. LOL

You know how much money he make already from these two…

Always better to listen to the old experience master.

One person quote to me before "After many years of investing, you will realise that investing in blue chip is still the best!"

http://createwealth8888.blogspot.sg/2014/12/keppel-corp-and-semcorp-ind.html

master CW

what price can go in for keppel corp and semb corp?

hehehe, btw i do have semb corp at around 4.4

Semb corp at around 4.4. You bought a lot cheaper than me.

Read? Temporary losses never mind; Do you still don't mind when it is measured in terms of years???

I will be taking doses of panadol to ease headache and heartache at Apr/May 2015

🙁

hi CW,

my overall portfolio are down 20k now. no joke 🙂

my whole year 2014 dividend+ realised profit just enough to breakeven my paper loss.

白忙一场

Sorry to hear that your money works for free.

Warren Buffett also want to work for free once with Ben Graham!

Work for free once or twice ok, but cannot dun learn!

I should alrdy faint since I own Val, Swissco n Ezion …

U insider. Steady one

Insider first to die ok…. LOL

Ok lar …..less than 20% of my portfolio. If they de-listed or crash like the 3 losers of B,L,A.

Then I have to learn trading, futures, CFD….. from you know who….