Patience is Wisdom

Last year, a very good friend who is successful in career and family management (4 kids) told me that he just attended courses on stocks investments, and he is excited to put money into the market. Of course those so-called Guru teacher has strongly encourage their investment “now” and “not wait”. My friend asked for my advice. I explained that knowledge of financial management including investment or creating a portfolio is imperative in life. But perhaps it is not the right time to invest since the Market is really way too high. He accepted my advice. Just this week, we exchanged messages and he told me market is plunging like mad and of course I know he is glad. Patience is also wisdom. I told him perhaps it is a good time to invest now!

I was very active in stocks in 2013,14,15,16. And started blogging in 2014 and very active through to 2016. Since late 2015, I had been offloading stocks progressively, holding more cash and precious metals until now, believing the market is over-priced with impending crash that can potentially be worse than the GFC.

2016 Nov : Only 10% in stock. Refer my article here.

2019 July : 39% Cash, 37% metals, 6 % crypto, 9% shares, 9% bonds,. CPF and properties excluded. Refer to my article here.

2020 Mar : 39% Cash, 36% metals, 7% crypto, 10% shares, 8% bonds,. CPF and properties excluded.

Without doubt, I am grateful for the patience exhibited since late 2015 to 2016. Almost all my portfolio can be liquidated now without loses and in fact some gains!

- Metals: Gold 40%, Silver 60%. Gold gain, Silver dipped. USD against SGD rise. Overall still decent net gain.

- Crypto: Started early 2019 and still net gain. Refer proof of article from Mar 2019 here.

- Shares since 2015-2016: Keppel DC Reit (> double bagger). Raffles Hospital (>30% drop). SPH Reit (almost same). Overall more or less same. But earn dividends over years.

- Bonds: 50% SSB, 50% corporate bond. Can be liquidated anytime with no losses.

Time to monitor closely on stocks, and always be prepared to deploy Warchest cautiously.

While fundamental analysis of a company is utmost importance, being at the right place at the right time can be of equal or more important. The former is technical knowledge. The latter is wisdom.

Technical knowledge is via hardwork and research. Wisdom is amassed through years of experiences, failures and exposure, not just in stock but also in life.

Déjà vu of 2016 Jan

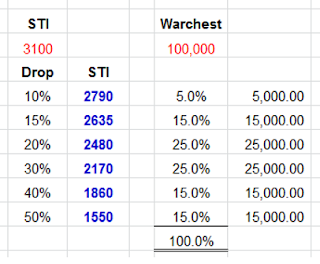

Jan 2016 I wrote an article when STI drops below 2800 and what should we do. Refer here. The article is unquestionably very relevant now too. Below table depicts if you have 100K to invest, and how and when you can deploy the Warchest.

Conclusion

To conclude, it is definitely a better time to buy stocks now than last year. But perhaps not excessively, starting with a small percentage of cash.

This is because Market Crash usually takes several months to a year or so to bottom out.

E.g.

GFC : Peaked Oct 2007. Bottom Mar 2009. ~ 1.5 years

2015-2016 sell off : Peaked Apr 2015. Bottom Feb 2016 ~ 10 months.

In Part 2, I will go more in depth into simple charts analysis to come to a conclusion if we should immediately rushed to put all our cash into stocks now. And perhaps Part 3, stocks to put in watchlist.

To be continued …..

DO YOU NEED A LOAN?

DO NOT KEEP YOUR FINANCIAL BURDEN TO YOURSELF CONTACT US NOW FOR ANY KIND OF LOAN AT A LOW INTEREST OF 2%. [email protected] whatsapp: +16673078785

Our loans are well insured for maximum security is our priority, Our leading goal is to help you get the service you deserve, Our Loan program is the quickest.

We give out loan in any currency of your choice Yuan, Dollar, Thai baht, Euro, Dinar, etc} and duration of 1 to 30 years to pay back the loan (secure and unsecured).

Do you need any kind of loan and have low credit score, Have you find it difficult to get loans from local banks and other financial institutions? solution to your financial problem is STEVE WILSON LOAN FIRM.

The terms and conditions are very reasonable and considerate.

We offer a wide range of financial services which includes: Xmas Loans, Business Loans, Debt Consolidation Loans, Personal Loans, Car loans, Hotel loans, Student loans, Home Refinancing Loans with low interest rate @2% per annul for individuals, companies and corporate bodies.

Interested applicants should Contact us via email:[email protected]. whatsapp:+16673078785 Apply and be free from financial bondage.

Company website:https://stevewilsonfinancialloanfirm.webs.com/

URGENT LOAN OFFER WITH 3% INTEREST RATE APPLY TODAY.

Do you need finance to start up your own business or expand your business, Do you need funds to pay off your debt? We give out loan to interested individuals and company's who are seeking loan with good faith. Are you seriously in need of an urgent loan contact us.

Email: [email protected]

LOAN APPLICATION DETAILS.

First Name:

Last Name:

Date Of Birth:

Address:

Sex:

Phone No:

City:

Zip Code:

State:

Country:

Nationality:

Occupation:

Monthly Income:

Loan Amount:

Loan Duration:

Purpose of the loan:

Email: [email protected]

URGENT LOAN OFFER WITH 3% INTEREST RATE APPLY TODAY.

Do you need finance to start up your own business or expand your business, Do you need funds to pay off your debt? We give out loan to interested individuals and company's who are seeking loan with good faith. Are you seriously in need of an urgent loan contact us.

Email: [email protected]

LOAN APPLICATION DETAILS.

First Name:

Last Name:

Date Of Birth:

Address:

Sex:

Phone No:

City:

Zip Code:

State:

Country:

Nationality:

Occupation:

Monthly Income:

Loan Amount:

Loan Duration:

Purpose of the loan:

Email: [email protected]

URGENT LOAN OFFER WITH 3% INTEREST RATE APPLY TODAY.

Do you need finance to start up your own business or expand your business, Do you need funds to pay off your debt? We give out loan to interested individuals and company's who are seeking loan with good faith. Are you seriously in need of an urgent loan contact us.

Email: [email protected]

LOAN APPLICATION DETAILS.

First Name:

Last Name:

Date Of Birth:

Address:

Sex:

Phone No:

City:

Zip Code:

State:

Country:

Nationality:

Occupation:

Monthly Income:

Loan Amount:

Loan Duration:

Purpose of the loan:

Email: [email protected]

URGENT LOAN OFFER WITH 3% INTEREST RATE APPLY TODAY.

Do you need finance to start up your own business or expand your business, Do you need funds to pay off your debt? We give out loan to interested individuals and company's who are seeking loan with good faith. Are you seriously in need of an urgent loan contact us.

Email: [email protected]

LOAN APPLICATION DETAILS.

First Name:

Last Name:

Date Of Birth:

Address:

Sex:

Phone No:

City:

Zip Code:

State:

Country:

Nationality:

Occupation:

Monthly Income:

Loan Amount:

Loan Duration:

Purpose of the loan:

Email: [email protected]

I was just browsing through the internet looking for some information and came across your blog. I am impressed by the information that you have on this blog. It shows how well you understand this subject. Bookmarked this page, will come back for more. Buy Social Bookmarking

Pretty good post. I just stumbled upon your blog and wanted to say that I have really enjoyed reading your blog posts. Any way I'll be subscribing to your feed and I hope you post again soon. Big thanks for the useful info. Buy YouTube Likes

God i thank you for sending this reliable loan lender to me this year 2020 to change my business and life financially. Its a good year for me already and not as worst as 2017 and 2019 that the two loan lenders i came across were scammers and liars.Its just to wait now for this pandemic to pass away to make good use of this loan i got from you sir to get my clothing business going more.

First I want to start with thanksgiving to God who made it possible for me to know Dr Derek Barlow the CEO of Barlow loans worldwide. After been scammed severally by two fake online loan lenders. Me coming across a loan firm as this really open doors for my business and financial need that has been broken for 4 years now. Dr Derek is a God sent to the world when it comes to help and granting loans to all around the continent and not just me alone. Oh no wonder serious and reliable business men and women and all around the world is talking positively about you sir and your reliable work. Again am happy that my past experience in the hands of those fraudsters that scammed me out of my hard earned money twice online did not make me give up and turn your offer to help me down when you were willing to help. Hey people i have gotten myself my dream loan to establish my own company and be financially stable as all this was done by Barlow loans. After going through tears in the hands of those online fraudsters, I knew i still have hopes of meeting a real and straight forward loan lender someday which really came to pass on the 11th of this month. Barlow loans worldwide made me to really confirm the part of the holy bible that says out of twelve there must really be a Judah. Kudos to the board of directors of Barlow loans that really granted me my dream loan of $155000 CAD. Hey people on earth, I dont really know who i am trying to help with this post that need loan not to contact the wrong loan firm or person, But what i know is that i have contributed my own part to your financial success by coming openly online to tell everyone on earth that if you need a loan, Kindly be of good to yourself to contact only Barlow loans worldwide as they grant loans to anybody no matter your tribe, religion, color and culture. Praise God that Barlow loans could help me financially with there reliable loan lending services. The board of directors of Barlow loans, i dont really know how to say thank you as i felt this my post will be one of what i can use to tell you thank you and also direct those that need loan to contact you and not to disturb you to avoid them contacting the wrong and fake loan lenders just the way i did before i came in contact with you sir. Reach out to them on there company email address which is /// [email protected] . Mind you that is to contact him for loan that there are procedures that has to be taken to get your loan and if you dont meet with them there is no how you can be granted a loan at Barlow loans worldwide as they are know for reliability.

Hello everyone, Are you into trading or just wish to give it a try, please becareful on the platform you choose to invest on and the manager you choose to manage your account because that’s where failure starts from be wise. After reading so much comment i had to give trading tips a try, I have to come to the conclusion that binary options pays massively but the masses has refused to show us the right way to earn That’s why I have to give trading tips the accolades because they have been so helpful to traders . For a free masterclass strategy kindly contact ([email protected]) for a free masterclass strategy. He'll give you a free tutors on how you can earn and recover your losses in trading for free..

Therefore dissertation web-sites as a result of online to set-up safe and sound ostensibly taped in the website. Buy Facebook Likes

ALL LOAN SERVICES AVAILABLE

Commercial Loans

Personal Loans

Business Loans

Investments Loans

Development Loans

Acquisition Loans

Construction loans

Business Loans And many More:

Call or add us on what's app +91-9818603391

Contact Us At : [email protected]

Mr.Clem Alpha

E-mail : [email protected]

Face à la crise sanitaire du coronavirus, beaucoup de personnes risquent de rencontrer des difficultés pour rembourser leur crédit immobilier ou à la consommation, du fait d'une baisse de leurs revenus : chômage partiel ou arrêt de travail pour certains salariés, baisse ou arrêt de l'activité pour les indépendants, les commerçants, les professions libérales, les micro-entrepreneurs.

Et nous savons que l'obtention d'un prêt légitime a toujours été un énorme problème. Pour les personnes qui ont un problème financier et qui ont besoin d'une solution, beaucoup de gens éprouvent des difficultés à obtenir un prêt en actions auprès de leurs banques locales ou d'autres institutions financières en raison d'un intérêt élevé, taux , garantie insuffisante, ratio dette / revenu, faible cote de crédit ou toute autre raison.

C'est dans cette optique de satisfaire la population que notre service de crédit financier mette à votre disposition des prêts à long terme et à court terme et vous pouvez également emprunter jusqu'à 15 millions d'euros. Notre structure vous aidera à atteindre divers objectifs avec une large gamme de produits de prêt.

Plus de temps d'attente ni de visites bancaires stressantes. Vous pouvez obtenir un prêt et compléter vos transactions quand et où vous en avez besoin.

Nous fournissons des services de prêt de classe mondiale 24 heures. Pour des demandes / questions?

– Envoyez un e-mail à [email protected]

Are you in need of Urgent Loan Here no collateral required all problem regarding Loan is solve between a short period of time with a low interest rate of 2% and duration more than 20 years what are you waiting for apply now and solve your problem or start a business with Loan paying of various bills You have come to the right place just

contact us [email protected]

whatspp Number +918929490461

Mr Abdullah Ibrahim

Are you in need of Urgent Loan Here no collateral required all problem regarding Loan is solve between a short period of time with a low interest rate of 2% and duration more than 20 years what are you waiting for apply now and solve your problem or start a business with Loan paying of various bills You have come to the right place just

contact us [email protected]

whatspp Number +918929490461

Mr Abdullah Ibrahim

Natural herbs have cured so many illness that drugs and injection can’t cure. I've seen the great importance of natural herbs and the wonderful work they have done in people's lives. i read people's testimonies online on how they were cured of HERPES, HIV, diabetics etc by Dr Edes herbal medicine, so i decided to contact the doctor because i know nature has the power to heal anything. I was diagnosed with Herpes for the past 3 years but Dr Edes cured me with his herbs and i referred my aunt and her husband to him immediately because they were both suffering from Herpes but to God be the glory, they were cured too .I know is hard to believe but am a living testimony. There is no harm trying herbs, Thanks. Write him on WhatsApp on +2348151937428. @dr_edes_remedies deals with

(1)Alzheimer virus

(2)Cancer

(3)HIV

(4)Herpes

(5)Genital warts

(6)ALS

(7)Virginal infection

(8)HPV

(9)Hepatitis

(10)Asthma

Email him on [email protected]

https://dredesherbalhome.weebly.com

Do you need Personal Loan?

Business Cash Loan?

Unsecured Loan

Fast and Simple Loan?

Quick Application Process?

Approvals within 24-72 Hours?

No Hidden Fees Loan?

Funding in less than 1 Week?

Get unsecured working capital?

Contact Us At : [email protected]

Phone number :+91-9818603391 (Whatsapp Only)

LOAN SERVICES AVAILABLE INCLUDE:

================================

*Commercial Loans.

*Personal Loans.

*Business Loans.

*Investments Loans.

*Development Loans.

*Acquisition Loans .

*Construction loans.

*Credit Card Clearance Loan

*Debt Consolidation Loan

*Business Loans And many More:

LOAN APPLICATION FORM:

=================

Full Name:…………….

Loan Amount Needed:.

Purpose of loan:…….

Loan Duration:..

Gender:………….

Marital status:….

Location:……….

Home Address:..

City:…………

Country:……

Phone:……….

Mobile / Cell:….

Occupation:……

Monthly Income:….

Contact Us At [email protected]

Phone number :+91-9818603391 (Whatsapp Only)