This post

directly continues from the previous post – Part

1.

directly continues from the previous post – Part

1.

The

financial world did unexpectedly well in the last seven years after the GFC!

financial world did unexpectedly well in the last seven years after the GFC!

Many

argued, “Isn’t this good news that everything is just fine? If Big Ben did not

“print” the world out of recession, perhaps we would be seeing one of the worst

crises since the Great Depression on the 1930s.”

argued, “Isn’t this good news that everything is just fine? If Big Ben did not

“print” the world out of recession, perhaps we would be seeing one of the worst

crises since the Great Depression on the 1930s.”

So everything

is great now! I should be happy right?

is great now! I should be happy right?

Why am I still

writing all these melancholy articles? In the last one year or so, I had been acting

like a doomsayer sounding alarms. I am

not even a financial expert, maybe just having a little edge in the Oil &

Gas industry. It is not just me merely by

word of mouth, but also the immense motivation from within to spend remarkable

huge amount of time and effort devoted in researching and then writing it here on

my blog. No specific agenda, nothing material to gain out of it too. Yet, I did

it! Even I cannot comprehend where is the strength behind? But strangely, there seems to have a colossal

force within me coercing me to sound out what I come to know of.

writing all these melancholy articles? In the last one year or so, I had been acting

like a doomsayer sounding alarms. I am

not even a financial expert, maybe just having a little edge in the Oil &

Gas industry. It is not just me merely by

word of mouth, but also the immense motivation from within to spend remarkable

huge amount of time and effort devoted in researching and then writing it here on

my blog. No specific agenda, nothing material to gain out of it too. Yet, I did

it! Even I cannot comprehend where is the strength behind? But strangely, there seems to have a colossal

force within me coercing me to sound out what I come to know of.

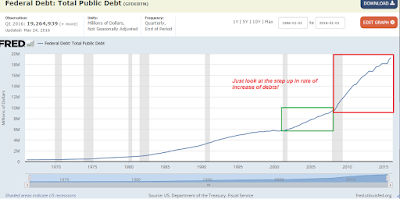

By the way,

please look at the above chart showing the unprecedented growth of US total public

debt over the years to >19 trillions today. Note the step up in the rate of

increase.

please look at the above chart showing the unprecedented growth of US total public

debt over the years to >19 trillions today. Note the step up in the rate of

increase.

In any

case, total public debt is only the debt owed by the central government. If we

add up the combination of government, business, mortgage and consumer debt, total

US debt today is >$63 trillion. 40 years ago, it was only $2.2 trillion.

case, total public debt is only the debt owed by the central government. If we

add up the combination of government, business, mortgage and consumer debt, total

US debt today is >$63 trillion. 40 years ago, it was only $2.2 trillion.

Today the

global debt is so remarkably huge, that my fear is that if ever this big bubble

is to burst one day, it’s going to be not just undesirable but painfully

scarier and longer lasting than even both Great Depression and GFC combined.

global debt is so remarkably huge, that my fear is that if ever this big bubble

is to burst one day, it’s going to be not just undesirable but painfully

scarier and longer lasting than even both Great Depression and GFC combined.

Imagine you are sick and need

to have one leg amputated to save your life. It is going to be painful in the

short term. However, if you are strong mentally, chance of recovery to lead a

normal life is high. Instead you choose that the doctor prescribed you with

some kind of unproven drugs or steroids to artificially prolong your life. In

the short run, you seems to recover and able to lead a normal life. You are

happy and cheer the doctor (or Fed) as your savior! Yet, one day some years

later, it is only inevitable that the virus in your body is going to became so

widespread that they will be entirely immune to the steroids. The steroids

intending to cure the initial virus actually also cause severe harm to other

parts of your body. The damage is non-repairable and you either die or become

forever bedridden. You wish you should just have the courage to amputate your

leg since the beginning. It is too late!

to have one leg amputated to save your life. It is going to be painful in the

short term. However, if you are strong mentally, chance of recovery to lead a

normal life is high. Instead you choose that the doctor prescribed you with

some kind of unproven drugs or steroids to artificially prolong your life. In

the short run, you seems to recover and able to lead a normal life. You are

happy and cheer the doctor (or Fed) as your savior! Yet, one day some years

later, it is only inevitable that the virus in your body is going to became so

widespread that they will be entirely immune to the steroids. The steroids

intending to cure the initial virus actually also cause severe harm to other

parts of your body. The damage is non-repairable and you either die or become

forever bedridden. You wish you should just have the courage to amputate your

leg since the beginning. It is too late!

If this is

true, which I pray it is not! Then wouldn’t you prefer that Fed Reserve just

let the “too big to fail” companies failed during GFC or will you still prefer

Fed to inject the economy with the artificial support!

true, which I pray it is not! Then wouldn’t you prefer that Fed Reserve just

let the “too big to fail” companies failed during GFC or will you still prefer

Fed to inject the economy with the artificial support!

Still want

to thank Big Ben for bring us out of recession so quickly in 2008?

to thank Big Ben for bring us out of recession so quickly in 2008?

The longer

the artificial support, the worst it gets later!

the artificial support, the worst it gets later!

George Soros

Even

legendary investor George Soros concur during a lecture at the Central European

University in October 2009 concur that he failed to anticipate the extent

of the rebound. Nonetheless he warned that,

legendary investor George Soros concur during a lecture at the Central European

University in October 2009 concur that he failed to anticipate the extent

of the rebound. Nonetheless he warned that,

“The longer the turnaround lasts the

more people will come to believe in it but in my judgment, the prevailing mood

is far removed from reality. This is characteristic of far-from-equilibrium

situations when perceptions tend to lag behind reality. To complicate matters,

the lag works in both directions. Most people have not yet realized that this

crisis is different from previous ones-that we are at the end of an era.”

more people will come to believe in it but in my judgment, the prevailing mood

is far removed from reality. This is characteristic of far-from-equilibrium

situations when perceptions tend to lag behind reality. To complicate matters,

the lag works in both directions. Most people have not yet realized that this

crisis is different from previous ones-that we are at the end of an era.”

Alan Greenspan

Alan

Greenspan who is Ben Bernanke’s predecessor as Fed Chairman is often being

accused to be one of the main creators of the housing bubbles leading to the

GFC. This is the man who ran the Federal Reserve for close to two decades and

who knows exactly what happened inside out. Interestingly, Greenspan had been

sounding alarms of the economy ever since he stepped down as Fed Chairman in

2006. In a very recent interview, Greenspan warned that US is running to a

state of disaster. He further adds,

Greenspan who is Ben Bernanke’s predecessor as Fed Chairman is often being

accused to be one of the main creators of the housing bubbles leading to the

GFC. This is the man who ran the Federal Reserve for close to two decades and

who knows exactly what happened inside out. Interestingly, Greenspan had been

sounding alarms of the economy ever since he stepped down as Fed Chairman in

2006. In a very recent interview, Greenspan warned that US is running to a

state of disaster. He further adds,

“We have a global problem of a shortage

in productivity growth and it’s not only the United States but it’s pretty much

around the world, and it’s being caused by the fact that populations everywhere

in the Western world are aging, and we’re not committing enough of our

resources to fund that. We should be running federal surpluses right now not

deficits. This is something we could have anticipated twenty five years ago and

in fact we did, but nobody’s done anything about it. This is the crisis which

has come upon us.”

in productivity growth and it’s not only the United States but it’s pretty much

around the world, and it’s being caused by the fact that populations everywhere

in the Western world are aging, and we’re not committing enough of our

resources to fund that. We should be running federal surpluses right now not

deficits. This is something we could have anticipated twenty five years ago and

in fact we did, but nobody’s done anything about it. This is the crisis which

has come upon us.”

Note that

Greenspan blamed it mainly on the low productivity growth of the world today

rather than explicitly pointing finger at the unrestrained creation of currency.

You should know why? LOL!

Greenspan blamed it mainly on the low productivity growth of the world today

rather than explicitly pointing finger at the unrestrained creation of currency.

You should know why? LOL!

Others warning too

Other

financial experts such as Ray Dalio, Robert Schiller, Jim Rogers, Carl Icahn,

Bill Gross, Marc Faber, Robert Kiyosaki, Mike Maloney, Peter Schiff and many

more are all cautioning about the excessive global currency supply causing

potentially BIGGER problems than the GFC in the roads ahead.

financial experts such as Ray Dalio, Robert Schiller, Jim Rogers, Carl Icahn,

Bill Gross, Marc Faber, Robert Kiyosaki, Mike Maloney, Peter Schiff and many

more are all cautioning about the excessive global currency supply causing

potentially BIGGER problems than the GFC in the roads ahead.

Rolf’s

thoughts

thoughts

I am not

saying that George Soros and the rest of those aforementioned will definitely

be right in their opinions or predictions. However most of them are the

vanguard of the industry who possess vast experiences and successful track

records in the financial market. It is definitely worthwhile to pay some

attention to it.

saying that George Soros and the rest of those aforementioned will definitely

be right in their opinions or predictions. However most of them are the

vanguard of the industry who possess vast experiences and successful track

records in the financial market. It is definitely worthwhile to pay some

attention to it.

Singapore economy in general

As for

Singapore, it is without any doubt we did exceptionally well economically

in the last decade. On the other hand, while not discrediting

Singaporean’s hard work and productivity growth in the last ten years, we

should be not over-conceited with our remarkable success attributed entirely

based on our capability and effort. A large part of it, are due to

both easy global monetary and loosed local immigration policies. This in my

opinion cannot be continued in such an explosive and unrestrained manner.

Singapore, it is without any doubt we did exceptionally well economically

in the last decade. On the other hand, while not discrediting

Singaporean’s hard work and productivity growth in the last ten years, we

should be not over-conceited with our remarkable success attributed entirely

based on our capability and effort. A large part of it, are due to

both easy global monetary and loosed local immigration policies. This in my

opinion cannot be continued in such an explosive and unrestrained manner.

If we take

a trip down to memory lane, our National growth from year 1965-2000, is based

on improving skills, raise productivity, increase knowledge, attract foreign

investments, build factories, infrastructure, develop ports and airports,

improve education, healthcare, housing etc.

a trip down to memory lane, our National growth from year 1965-2000, is based

on improving skills, raise productivity, increase knowledge, attract foreign

investments, build factories, infrastructure, develop ports and airports,

improve education, healthcare, housing etc.

How about

in the last decade or so? Can you recall specifically what the main impetuses

of growth were? Population growth from loose immigration policy! Real estate

boom! Banking sectors thriving with some much global liquidity flowing to

Singapore, yes… includes 1MDB as well. The inertias of growth are totally

different. This is exactly what Ray Dalio mentioned about the different stages

of economy.

in the last decade or so? Can you recall specifically what the main impetuses

of growth were? Population growth from loose immigration policy! Real estate

boom! Banking sectors thriving with some much global liquidity flowing to

Singapore, yes… includes 1MDB as well. The inertias of growth are totally

different. This is exactly what Ray Dalio mentioned about the different stages

of economy.

Undoubtedly

I admit that Singapore have exceptional strong governance and leadership.

Furthermore attracting foreign talents is essential due to our aging

population. I am also not asking Singapore to stop growing, stagnate or even go

backwards. However everything should be in moderation and within a more

reasonable pace for all people also to adapt. The focus on economic growth

versus productivity and education should be tilted correctly and carefully. As I

see now, Singapore appears to have already learned our lesson in the last ten years

of exuberance, because of governmental change of focus in recent times. Apparently

our Prime Minister Lee Hsien Loong had since contracted cancer again last year and

had since recovered too! Perhaps there is a more divine message within on PM

Lee’s illness and recovery.

I admit that Singapore have exceptional strong governance and leadership.

Furthermore attracting foreign talents is essential due to our aging

population. I am also not asking Singapore to stop growing, stagnate or even go

backwards. However everything should be in moderation and within a more

reasonable pace for all people also to adapt. The focus on economic growth

versus productivity and education should be tilted correctly and carefully. As I

see now, Singapore appears to have already learned our lesson in the last ten years

of exuberance, because of governmental change of focus in recent times. Apparently

our Prime Minister Lee Hsien Loong had since contracted cancer again last year and

had since recovered too! Perhaps there is a more divine message within on PM

Lee’s illness and recovery.

Be happy, but be grateful and humble

Therefore,

in the last decade, if you think that you are very capable and successful, let

it be in your business, investments in stocks or real estates or job in

Singapore, you ought to think again! For those who never go through either

one of the AFC, SARs GFC, it was an even more smooth-sailing ride assisted by

the rising tides of the global economy fuel by the cheap credit from a series

of Quantity Easing. This is not to mention those whose wealth grew

exponentially from excessive leverage. Leverage can be a double-edged sword.

During good times, you thrive. During bad times, you dive.

in the last decade, if you think that you are very capable and successful, let

it be in your business, investments in stocks or real estates or job in

Singapore, you ought to think again! For those who never go through either

one of the AFC, SARs GFC, it was an even more smooth-sailing ride assisted by

the rising tides of the global economy fuel by the cheap credit from a series

of Quantity Easing. This is not to mention those whose wealth grew

exponentially from excessive leverage. Leverage can be a double-edged sword.

During good times, you thrive. During bad times, you dive.

I am not

asking that we should entirely allay our own success. Maybe it is good to have

a tad of gratefulness and humility.

asking that we should entirely allay our own success. Maybe it is good to have

a tad of gratefulness and humility.

My own career

By the

way, my own career in the Oil and Gas industry had benefited greatly from the economic

boom too since 2003/4, which resulted in my own bucket of gold. The GFC though

brought back painful memories of colleagues being retrenched. Nonetheless GFC

was short-lived so are any of our painful memories of it. The market rebounded

fast and re-employment was easy. On the contrary the current oil crisis edging

close to a two year period now is expected to be a longer and harsher one. Despite

still employed in the industry, I am also experiencing one of the most

challenging times ever in my career.

way, my own career in the Oil and Gas industry had benefited greatly from the economic

boom too since 2003/4, which resulted in my own bucket of gold. The GFC though

brought back painful memories of colleagues being retrenched. Nonetheless GFC

was short-lived so are any of our painful memories of it. The market rebounded

fast and re-employment was easy. On the contrary the current oil crisis edging

close to a two year period now is expected to be a longer and harsher one. Despite

still employed in the industry, I am also experiencing one of the most

challenging times ever in my career.

Final thoughts

I

definitely feel indebted to have enjoyed the economic boom in the last decade

or so, not just growing my wealth. More importantly, the joy of seeing the

growth of my beloved family is something no wealth can exchange for.

definitely feel indebted to have enjoyed the economic boom in the last decade

or so, not just growing my wealth. More importantly, the joy of seeing the

growth of my beloved family is something no wealth can exchange for.

My

personal taste of SARs, GFC and Oil Crisis and other personal crisis within

just slight more than 10 years also instill in me a great sense of resilience

going forward.

personal taste of SARs, GFC and Oil Crisis and other personal crisis within

just slight more than 10 years also instill in me a great sense of resilience

going forward.

I also

believed I am blessed with the right age to benefit from this experience which

will definitely come in handy one day in the future.

believed I am blessed with the right age to benefit from this experience which

will definitely come in handy one day in the future.

In any

case, I am still very positive about the world of tomorrow. With humility

and prudence, I believe those armed with proper financial knowledge and vision

of the long term future will stand out and thrive. Above all, you just need patience

and the right temperament!

case, I am still very positive about the world of tomorrow. With humility

and prudence, I believe those armed with proper financial knowledge and vision

of the long term future will stand out and thrive. Above all, you just need patience

and the right temperament!

I leave

you with my core values in life. Read: Defining My Core

Values – Rolf Suey

you with my core values in life. Read: Defining My Core

Values – Rolf Suey

Then there

is also my new found AAA theory: Anticipate, Adapt,

Action!

is also my new found AAA theory: Anticipate, Adapt,

Action!

Thank

you for reading and stay tuned to Part 3.

you for reading and stay tuned to Part 3.

PS: If you think you have benefitted in any ways (big or small) from my blog or this article, do subscribe to my blog and also help to spread the beliefs. Thank you.

Related posts:

i see you have become friends with the flintstones.lol

Not proselytizing, but just convinced about the truth.

The truth is hardest to accept, even flintstones doubted!

Follow my heart, and most of the time it is not what most love to hear!

LOL.

I meant Fred. Fred flintstone

Hmm… SMK do not know what u mean leh!

U mean character of Flinstone or Barney Rubble? Shorting rubble?

i meant Fed's fred app.

Thanks for this refreshing article!

The motto of the blog is the best one. When we read such articles as the one above, we also become the investors in our own financially independent future. Before our country starts living the Singapore’s economy, we’d better find out about instant loans no credit check now. Perhaps I didn’t understand some of the finance terminology. But I surely enjoyed reading Rolf’s thoughts on the subject. I will be waiting for more revealing Part 3 now. Final thoughts of the post are the most powerful and calling us to start thinking for ourselves.