It comes to a surprise to me that IDA announced a fourth

Telco.

Telco.

Why fourth Telco?

Considering the weak economic conditions, I am not sure why IDA

wanted a fourth telco NOW. Yeah, IDA mentioned it is for the sake of the

consumers having better choice. We already have three to choose from. Not

enough for now? How about we should have another Broadcast company since

Mediacorp has been producing year over year lousy TV serials.

wanted a fourth telco NOW. Yeah, IDA mentioned it is for the sake of the

consumers having better choice. We already have three to choose from. Not

enough for now? How about we should have another Broadcast company since

Mediacorp has been producing year over year lousy TV serials.

Most likely to me, it seems the long term vision of Singapore,

planning for the 6.9 million population by 2030. Perhaps this cannot be one of

the reasons by the lips of IDA during the announcement as it will probably cause

a rant among local-bred Singaporeans.

planning for the 6.9 million population by 2030. Perhaps this cannot be one of

the reasons by the lips of IDA during the announcement as it will probably cause

a rant among local-bred Singaporeans.

Or maybe Keppel will sell her M1 stakes to Starhub?

Sales of Starhub & M1

Today, I made sales of both Starhub and M1 that I owned in my

SRS. For Starhub, I had owned the stock since 2013 and bought it over $4,

and subsequently averaged down. For M1, I recently bought it at $2.6 hoping

that the fourth Telco will not be announced. Including dividends, for both

trades, I still incur minor losses.

SRS. For Starhub, I had owned the stock since 2013 and bought it over $4,

and subsequently averaged down. For M1, I recently bought it at $2.6 hoping

that the fourth Telco will not be announced. Including dividends, for both

trades, I still incur minor losses.

Reasons – short term bearish

The fourth Telco will offer service as early as Apr-2017 and then

another bid for the 700MHz band around End 2017. Therefore throughout now

till end of 2017, I anticipate great volatility of share prices of the incumbent

telcos. And in an already crowded market where cashflow from TV/Mobile are

declining plus the current frail economic conditions, I am anticipating lower

pricing of Telco in the short term.

another bid for the 700MHz band around End 2017. Therefore throughout now

till end of 2017, I anticipate great volatility of share prices of the incumbent

telcos. And in an already crowded market where cashflow from TV/Mobile are

declining plus the current frail economic conditions, I am anticipating lower

pricing of Telco in the short term.

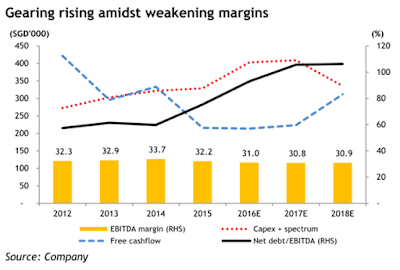

Starhub had somewhat

assured to pay out 20c DPS, which is an attractive 5.8% at current pricing of

3.46. This is despite that in FY15 that their net profit is flat at 0.5% growth

on a 2% decline in mobile revenue and a 3% drop in fixed network services. Pay

TV and broadband is still resilient even in the face of fierce competition. Furthermore,

gearing is set

to rise as

capex will remain high at 13% of

total revenue. Starhub also expect lower handset sales in 2016. The most discerning news is whether Starhub

can maintain its dividends since FCF has been declining over the years?

assured to pay out 20c DPS, which is an attractive 5.8% at current pricing of

3.46. This is despite that in FY15 that their net profit is flat at 0.5% growth

on a 2% decline in mobile revenue and a 3% drop in fixed network services. Pay

TV and broadband is still resilient even in the face of fierce competition. Furthermore,

gearing is set

to rise as

capex will remain high at 13% of

total revenue. Starhub also expect lower handset sales in 2016. The most discerning news is whether Starhub

can maintain its dividends since FCF has been declining over the years?

I will not go in depth into M1, since it is smaller portfolio for me compared to Starhub, but it is probably most

vulnerable to the fourth telco considering the fact that most of its revenue is

from Mobile.

vulnerable to the fourth telco considering the fact that most of its revenue is

from Mobile.

Source: Motley fool

Long Term Bullish

Frankly, I am still long term bullish about Telco. Hey…15 years 6.9 million is a long time. Yes, I know. That is not the main reason why I am bullish.

If you look at how Singtel and Starhub has evolved over the years since

1990s, it is not necessary that a phone operator will only be a phone operator

in the long run.

1990s, it is not necessary that a phone operator will only be a phone operator

in the long run.

Singtel has transformed from an Internet dial up, fixed line TV, Mobile

company to expanding her foothold in Australia, India.

company to expanding her foothold in Australia, India.

Similarly Starhub was

just a fixed network and mobile services in late 90s before becoming an

Internet service provider when it acquired CyberWay, and then later merged with

Singapore Cable Vision in early 2000s.

just a fixed network and mobile services in late 90s before becoming an

Internet service provider when it acquired CyberWay, and then later merged with

Singapore Cable Vision in early 2000s.

I will possibly wait for better entry points later for the Telco, or I may just put the money in Keppel DC Reit?

1) if long term bullish why sell it at a loss.

2) you did not really justify your long term bullishness. it is just hope.

anyway good writing.

Hi Anonymous,

1) Because u can buy back cheaper later in short to mid term!

2) Long term bullishness is justify by the eventual population growth which I mentioned. That also justify why u can buy back when price drop.

Thanks for the

Also for long term, if u see how telco in SG has evolved not just as a telco over the years.

It is not true that Starhub may remain as a telco only over time. This is the reason and in fact all is written in the last section.

Thanks for another informative website.

Very Interesting and very nice post awesome keep sharing.

thanks for sharing these articles. also read Resume Templates |

Nursing Schedule Template |

Free Rent Payment Tracker Spreadsheet |

thank you letter samples for donations |

career change cover letter |

daily sales report templates