STI closed at 2729.91 today, officially in a bear market declining

23% since its 1-year high of 3,539.95 on Apr 2015.

23% since its 1-year high of 3,539.95 on Apr 2015.

While

many are busy selling yesterday and today, I am busy buying. This is

according to my strategy since being patient for several months now.

many are busy selling yesterday and today, I am busy buying. This is

according to my strategy since being patient for several months now.

“Patience

for a reason!”

for a reason!”

Remember

your strategy is only as good as what you had planned earlier. What you plan is

only as good as what you learnt. What you learn is only as good as how much you

understand your own situation the best. Therefore understand yourself well. Different people will have different

strategies. Very often, it also depend on other financial or real life factors outside your stock portfolio, such as your work stability, any family stress, or personal mental well-being or even ask if your health be affected.

your strategy is only as good as what you had planned earlier. What you plan is

only as good as what you learnt. What you learn is only as good as how much you

understand your own situation the best. Therefore understand yourself well. Different people will have different

strategies. Very often, it also depend on other financial or real life factors outside your stock portfolio, such as your work stability, any family stress, or personal mental well-being or even ask if your health be affected.

The “spare

cash” or “warchest” like many people here in the blogosphere like to refer to

as, has to be deployed over a period of time during bear market.

cash” or “warchest” like many people here in the blogosphere like to refer to

as, has to be deployed over a period of time during bear market.

While I

am not disclosing the exact detail/amount how I am going to deploy my warchest

so as to NOT to mislead and also because “you are not me and I am not you”, there

are some guidelines. The key or basic principle is:

am not disclosing the exact detail/amount how I am going to deploy my warchest

so as to NOT to mislead and also because “you are not me and I am not you”, there

are some guidelines. The key or basic principle is:

“Remember

to eat slowly; do not be greedy and eat all at once, otherwise you will suffer

indigestion, and vomit all out.”

to eat slowly; do not be greedy and eat all at once, otherwise you will suffer

indigestion, and vomit all out.”

One of

the ways of deploying as very rough guide is written by Motley Fool – Refer

here.

the ways of deploying as very rough guide is written by Motley Fool – Refer

here.

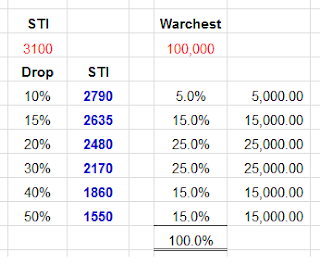

Similarly, you can also create your own spreadsheet. Something like below and play with

the percentages and figures accordingly base on the situation that suit you the best.

Below is an assumption of a 100k warchest with arbitrary percentage of warchest deploy.

the percentages and figures accordingly base on the situation that suit you the best.

Below is an assumption of a 100k warchest with arbitrary percentage of warchest deploy.

For me,

I scooped below stocks during this bear! Don’t ask me why these stocks? Haha….

I scooped below stocks during this bear! Don’t ask me why these stocks? Haha….

– Raffles Medical

– Singpost

– GLP

– China Merchant Pacific

Well. I also thinking to buy GLP and sing post.

Today I scope ocbc. Dbs and Kepple corp.

Hi Yeh,

Hope it turns out good. Do remember that banks & O&G r very volatile! For stocks I m not so sure esp in these two industries now, I give a pass! But regardless the case in the short term, these r good companies for the long term.

Remember to take ur time…

Lol….me still waiting to get cmp. After got in on ocbc and singtel.

Hi David,

Hmm… CMP is whipped heavily. The key next is how they r gg to sustain their dividend.

Well post and i read this this article and its give us good lesson how to help us thanks for sharing rephrase my sentence .