Both

my offshore stocks announced 2Q results this week. There is nothing too surprising

as both companies continue to achieve stellar growth year over year (yoy) at the back

of a strong offshore industry outlook.

my offshore stocks announced 2Q results this week. There is nothing too surprising

as both companies continue to achieve stellar growth year over year (yoy) at the back

of a strong offshore industry outlook.

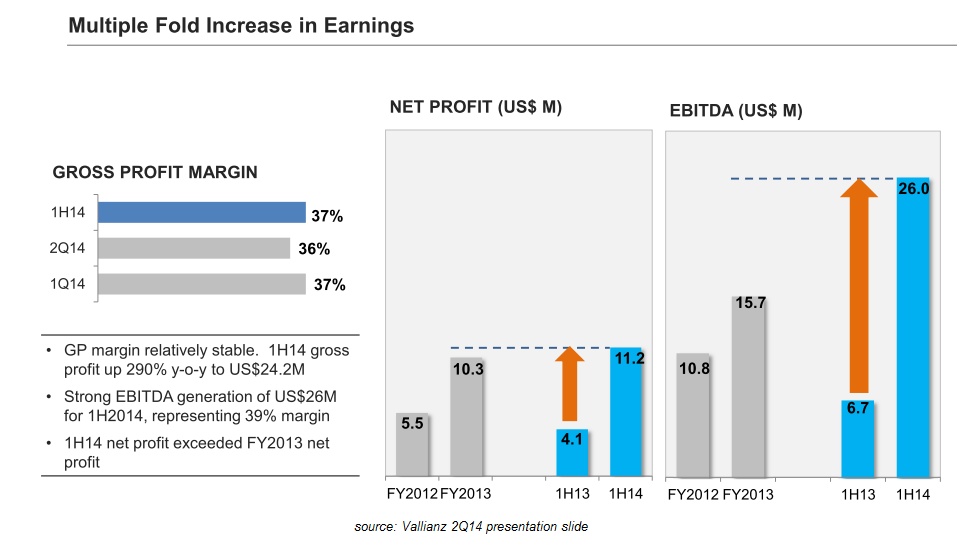

Vallianz – 1H14 net profit exceeded FY13 profit

For

2Q14 comparing yoy, Vallianz doubled its net profit to US$5.8m and group

revenue surged to US$38.6m vs US$4.7m. 1H14 net profit

surge 172% to US$11.2m on the back of 787% growth in revenue to US$66.3m. Revenue

expansion is propelled by long-term charters with major oil companies. GP

margin healthy and stable. Overall, 1H14 net profit exceeded FY2013 net Profit.

2Q14 comparing yoy, Vallianz doubled its net profit to US$5.8m and group

revenue surged to US$38.6m vs US$4.7m. 1H14 net profit

surge 172% to US$11.2m on the back of 787% growth in revenue to US$66.3m. Revenue

expansion is propelled by long-term charters with major oil companies. GP

margin healthy and stable. Overall, 1H14 net profit exceeded FY2013 net Profit.

As

of End 1H14, cash position increase to US$44.1m from US$1.8m half year ago. Shareholders’ equity increased to US$141.5m 1H14 vs

US$42.7m End13. Total liabilities were US$598.8m 1H14, comprising largely of

loans amounting to US$361.3m to finance the purchase of vessels. The Group also

has notes payable of US$124.9m that were issued under a Multicurrency Debt

Issuance Program.

of End 1H14, cash position increase to US$44.1m from US$1.8m half year ago. Shareholders’ equity increased to US$141.5m 1H14 vs

US$42.7m End13. Total liabilities were US$598.8m 1H14, comprising largely of

loans amounting to US$361.3m to finance the purchase of vessels. The Group also

has notes payable of US$124.9m that were issued under a Multicurrency Debt

Issuance Program.

Outlook

Pros: Higher revenue and

profits in FY14. Around 50% of current order book of US$494m, expected to be

recognised over 2014 and 2015. Prospects in Middle East and Mexico bright, and

target entrance to west Africa. Tendered 1.2b of projects, with its wide range

of vessel types at a healthy average fleet age of 2.3 years.

profits in FY14. Around 50% of current order book of US$494m, expected to be

recognised over 2014 and 2015. Prospects in Middle East and Mexico bright, and

target entrance to west Africa. Tendered 1.2b of projects, with its wide range

of vessel types at a healthy average fleet age of 2.3 years.

Cons: High growth from high debt means high risk. Employees may find

difficultly to cope and output may lag exuberance growth.

difficultly to cope and output may lag exuberance growth.

Nam Cheong – 1H14 Net Profit surged 75% yoy

For

2Q14, Nam Cheong ‘s net profit surges 53% to RM63.0m and revenue rises 38% to

RM378.8 million qoq. Gross profit margins still at healthy levels of 18% in 2Q14 although

it fall 2% yoy. For the 1H14 comparing yoy, Net profit

surged 75% to RM134.4m vs RM76.9m and Revenue rose 54% to RM786.1m vs RM510.1m.

2Q14, Nam Cheong ‘s net profit surges 53% to RM63.0m and revenue rises 38% to

RM378.8 million qoq. Gross profit margins still at healthy levels of 18% in 2Q14 although

it fall 2% yoy. For the 1H14 comparing yoy, Net profit

surged 75% to RM134.4m vs RM76.9m and Revenue rose 54% to RM786.1m vs RM510.1m.

Healthy

cash position of RM194.2m with low net gearing ratio of 0.60 times as at End

1H14, providing headroom for growth. NAV

per share as of end 1H14 is 47.6 sen vs 44.6 sen as seen End13.

cash position of RM194.2m with low net gearing ratio of 0.60 times as at End

1H14, providing headroom for growth. NAV

per share as of end 1H14 is 47.6 sen vs 44.6 sen as seen End13.

Outlook

Pros: Expect another record

year with 20 out of 30 vessels due for 2014 already sold. Large

order book of approx RM1.7 billion. Bright outlook driven by Petronas increase Capex

commitment.

year with 20 out of 30 vessels due for 2014 already sold. Large

order book of approx RM1.7 billion. Bright outlook driven by Petronas increase Capex

commitment.

Cons: Risk of Build to Stock business model unable to sell in situation of an

economic crunch.

economic crunch.

Related

Posts:

Posts: