In line

with my previous blog post Baker Technology Limited – Better

Tomorrow, Baker

Tech announced a set of poor 2Q2014 results earlier this week, due to lower

revenue and absence of divestment gain from Discovery Offshore (DO) Rig last

year.

with my previous blog post Baker Technology Limited – Better

Tomorrow, Baker

Tech announced a set of poor 2Q2014 results earlier this week, due to lower

revenue and absence of divestment gain from Discovery Offshore (DO) Rig last

year.

Quarterly Results – Earnings Plunged

For 2Q14,

- Net profit drop 92% to S$1m Vs S$11.3m yoy

- This

is due to absence of S$8.9m divestment gain on DO last year. - Excl gains, net profit drop 61% Vs S$2.5m yoy

- Rev

drop 20% to $17.8m Vs S$22.1m yoy - EPS

down to 0.1c Vs 1.35c yoy

For 1H14,

- Net profit fall 81% to S$2.7m Vs 14.6m yoy

- Excl gains, net profit fall 52% Vs S$5.7m yoy

- Rev

drop 23% to $36.8m Vs S$47.2m yoy - EPS

down to 0.31c Vs 1.84c yoy

The company

is experiencing higher payroll costs and higher operating expenditure as a

result of newly incorporated subsidiaries and new premises. Forex loss of

S$0.7m recorded due to weakening of USD against SGD. Shareholders’ funds down

15% as at 30 June 2014 due to payment of dividends of $45.2 million to

shareholders. This is partially offset by proceeds from the conversion of warrants

and retained profits for the period.

Strong Balance Sheet & Healthy Order Book

Financial

position is strong with $153.9 million in cash and short-term deposits with

zero gearing. Note however that cash position drop from 205.9m

reported as of End13, likely due to investments on new subsidiaries. Net order

book healthy at US$61m as at Jun14, with projects expected to be completed

within the last 12-18 months. The company also received Singapore corporate

awards 2014 for best managed board – gold, and best annual report – silver, for

companies with less than S$300m in market cap.

position is strong with $153.9 million in cash and short-term deposits with

zero gearing. Note however that cash position drop from 205.9m

reported as of End13, likely due to investments on new subsidiaries. Net order

book healthy at US$61m as at Jun14, with projects expected to be completed

within the last 12-18 months. The company also received Singapore corporate

awards 2014 for best managed board – gold, and best annual report – silver, for

companies with less than S$300m in market cap.

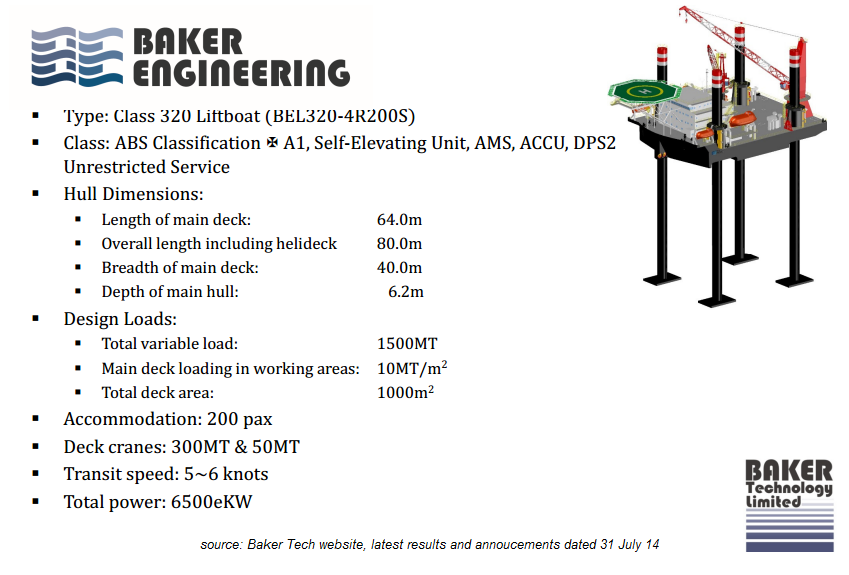

Prospects from new Liftboat Design

New subsidiary

Baker Engineering has launched its new liftboat business by completing its new

in-house design. Construction of liftboat will be commencing in Baker’s Singapore

yard for sale or ownership and charter with or without partners.

Baker Engineering has launched its new liftboat business by completing its new

in-house design. Construction of liftboat will be commencing in Baker’s Singapore

yard for sale or ownership and charter with or without partners.

Rolf’s View

Without

deviating from my views in Mar blogpost, near term business

prospects are very challenging due to competition on equipment business. This will thin revenue and profit margins and worsen without any contribution from divestment gains. The jackup

rig market near term prospect is also challenging with Keppel and Sembcorp rig

order intakes reducing and probable over-supply of rigs in the near term as a

results of IOC plan reduction in Capex. Refer to my blog post

deviating from my views in Mar blogpost, near term business

prospects are very challenging due to competition on equipment business. This will thin revenue and profit margins and worsen without any contribution from divestment gains. The jackup

rig market near term prospect is also challenging with Keppel and Sembcorp rig

order intakes reducing and probable over-supply of rigs in the near term as a

results of IOC plan reduction in Capex. Refer to my blog post

In my last

post on Baker Tech, I estimated that excluding divestment gains, profits estimated to be S$12-15m

range. From its latest 1H14 results, estimated annualized profits will be 11.4m.

The cash and equiv of S$154m as of End 1H14 translate to S$0.17 per share. At

current share price of S$0.27 with a market cap of S$244.4m, a very

conservative/rough estimate of the FY14 PE including cash on hand, is ~ 7 to 8x. This PE estimate still coincide with industry standard. Excluding cash, PE estimate is 21x.

post on Baker Tech, I estimated that excluding divestment gains, profits estimated to be S$12-15m

range. From its latest 1H14 results, estimated annualized profits will be 11.4m.

The cash and equiv of S$154m as of End 1H14 translate to S$0.17 per share. At

current share price of S$0.27 with a market cap of S$244.4m, a very

conservative/rough estimate of the FY14 PE including cash on hand, is ~ 7 to 8x. This PE estimate still coincide with industry standard. Excluding cash, PE estimate is 21x.

In the long

term (expect 2016 and beyond), the success of the company may fall on the shoulders of its new Liftboat

division. If successful, not only will the liftboat division contribute

positively to earnings from charter or divestment, it will also mean more

revenue for its very own Sea Deep equipment business of Jacking system, cranes,

skidding systems, fabrications etc. While

Liftboat market seems rather unpenetrated and very promising in this part of

the world, we are starting to see increase congestions from more and more players. Also refer to my blog post on

Liftboat below.

term (expect 2016 and beyond), the success of the company may fall on the shoulders of its new Liftboat

division. If successful, not only will the liftboat division contribute

positively to earnings from charter or divestment, it will also mean more

revenue for its very own Sea Deep equipment business of Jacking system, cranes,

skidding systems, fabrications etc. While

Liftboat market seems rather unpenetrated and very promising in this part of

the world, we are starting to see increase congestions from more and more players. Also refer to my blog post on

Liftboat below.

Related Posts: