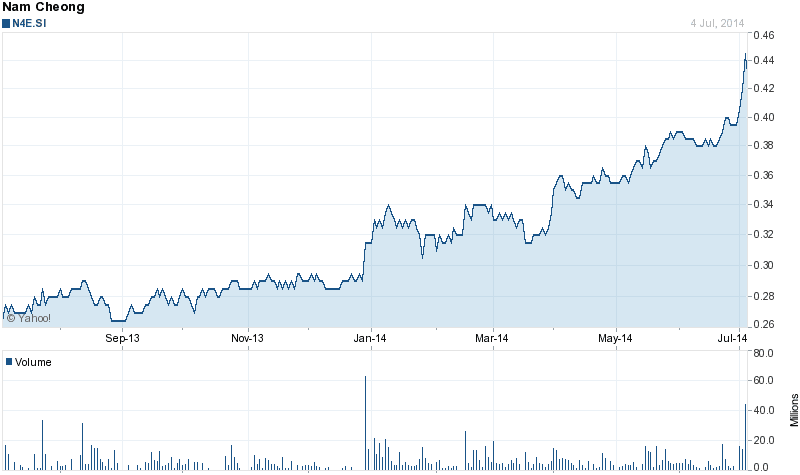

Nam

Cheong share price peak to S$0.45 this week following two announcements of US$176mil

contract wins in a space of less than two weeks. Nam

Cheong’s order book now boasts 25 vessels worth about RM1.7 billion. See

announcement here. A month ago Nam Cheong share price is still trading at S$0.38. Last

close price is S$0.44 representing >15% increase within a month.

Cheong share price peak to S$0.45 this week following two announcements of US$176mil

contract wins in a space of less than two weeks. Nam

Cheong’s order book now boasts 25 vessels worth about RM1.7 billion. See

announcement here. A month ago Nam Cheong share price is still trading at S$0.38. Last

close price is S$0.44 representing >15% increase within a month.

What is

Build-to-Stock Business Model?

Build-to-Stock Business Model?

An OSV typically takes 12-24 months to complete building. Many O&G

projects may require OSV owners to have ready vessels to work within a much

shorter time-frame. The mismatch in shipbuilding time and actual project

requirement means that OSV owners can tap on Nam Cheong’s build to stock

business model where vessels were built in advance before the actual project

taking place. This help to considerable reduce the delivery time for their

clients.

projects may require OSV owners to have ready vessels to work within a much

shorter time-frame. The mismatch in shipbuilding time and actual project

requirement means that OSV owners can tap on Nam Cheong’s build to stock

business model where vessels were built in advance before the actual project

taking place. This help to considerable reduce the delivery time for their

clients.

Build-to-Stock (BTS) Pre-requisites

Nam Cheong is require to know which Oil and Gas projects in preliminary bidding stage and who are the OSV players tendering for which specific projects. The

need to plan what type of vessels to build, and at what time to build, requires

Nam Cheong to have a extensive knowledge of the market and its

requirements. In a recent interview from “Business Times”, Nam Cheong CEO

mentioned that having comprehensive knowledge of the OSV market is imperative

for them. Their in-depth knowledge and cutting edge engineering capabilities

have also helped them to identify the most appropriate vessels to construct for

their clients.

need to plan what type of vessels to build, and at what time to build, requires

Nam Cheong to have a extensive knowledge of the market and its

requirements. In a recent interview from “Business Times”, Nam Cheong CEO

mentioned that having comprehensive knowledge of the OSV market is imperative

for them. Their in-depth knowledge and cutting edge engineering capabilities

have also helped them to identify the most appropriate vessels to construct for

their clients.

High Margin, High Risk

BTS Model

BTS Model

The BTS model enables Nam Cheong’s vessels to command a premium pricing.

Nam Cheong is considered to be one of the largest suppliers of shallow water

OSVs in the world today. Albeit higher return, its business model contain higher

risks as well. The inherent risk is cash. To build a vessel upfront before a

certain sale date requires financing support, increasing leverage throughout

the process.

Nam Cheong is considered to be one of the largest suppliers of shallow water

OSVs in the world today. Albeit higher return, its business model contain higher

risks as well. The inherent risk is cash. To build a vessel upfront before a

certain sale date requires financing support, increasing leverage throughout

the process.

Today, bank only lends with a contract backed vessels. Notably, cashflow problems claim victims such as Jaya

Holdings, Drydock World, Otto Marine during the Global financial crisis (GFC) in 2008. During the crisis, oil price takes a

plunge, many projects were cancelled and credit institutions tightened their

lending. Fearing default payments, equipment suppliers added additional

pressures to shipbuilders with a “no payment no progress” stipulation.

Holdings, Drydock World, Otto Marine during the Global financial crisis (GFC) in 2008. During the crisis, oil price takes a

plunge, many projects were cancelled and credit institutions tightened their

lending. Fearing default payments, equipment suppliers added additional

pressures to shipbuilders with a “no payment no progress” stipulation.

Sandwiched between cancelled projects from clients,

non-deliveries from suppliers and no-support from banks, companies who indulge

in speculative building such as Nam Cheong, Jaya, Drydock World, Otto Marine

are badly hit during the GFC.

non-deliveries from suppliers and no-support from banks, companies who indulge

in speculative building such as Nam Cheong, Jaya, Drydock World, Otto Marine

are badly hit during the GFC.

From above chart, we can see that Nam Cheong order wins take a huge dip to less

than three vessels in 2009.

than three vessels in 2009.

In the same period, Jaya seen its share price freefall from S$2 to 20 over cents and

acquired cheaply by Deutsche bank. Otto Marine still suffers from the

repercussions of the cancelled orders of four VS491 ultra-large AHTS today.

Drydock World filed for court protection in its financial re-structuring

process and was eventually sold to Kuok group.

acquired cheaply by Deutsche bank. Otto Marine still suffers from the

repercussions of the cancelled orders of four VS491 ultra-large AHTS today.

Drydock World filed for court protection in its financial re-structuring

process and was eventually sold to Kuok group.

How to Mitigate Risk

Proven Vessel Design in the shallow water segment

With a good understanding of the shallow water market segment, Nam

Cheong mitigates risks by only building OSVs with a broad market appeal, certified

by international class society such as ABS, DNV, GL etc. Their vessels also includes

more simpler and standardized designs such as

5150, 8000, 10,800 BHP AHTS, 300men AWB, 3000DWT PSV, ERRV etc. This is also one of

the reasons why it manages to sold off the stock vessels after the crisis. In

comparison, Otto had great difficulties selling off the four ultra large AHTS

cancelled by its Norwegian investor Mosvold shipping. Jaya also suffered from its inability to sell off its more

complicated high value OSVs then.

Cheong mitigates risks by only building OSVs with a broad market appeal, certified

by international class society such as ABS, DNV, GL etc. Their vessels also includes

more simpler and standardized designs such as

5150, 8000, 10,800 BHP AHTS, 300men AWB, 3000DWT PSV, ERRV etc. This is also one of

the reasons why it manages to sold off the stock vessels after the crisis. In

comparison, Otto had great difficulties selling off the four ultra large AHTS

cancelled by its Norwegian investor Mosvold shipping. Jaya also suffered from its inability to sell off its more

complicated high value OSVs then.

Strong Customer Relationship

To bid in Malaysia Petronas projects, you are require to have the “Petronas

license to bid”. Being located in Malaysia with a many repeat clients such as

Bumi, Perdana, Nam Cheong is benefitting from the local content requirement.

Since 2007, Nam Cheong already sold 17 vessels to Bumi and 12 vessels to

Perdana excluding the recent 2 x AWB. This is the kind of “Kampung bond” you

will still find in Malaysia today. Of course the primary driver is still

Petronas huge Capex plans going forward. Nam Cheong also established a

solid client relationships with International OSV players. They are Tidewater (one

of the largest OSV owners in

the world), Europe-based Vroon

and Middle East-based Topaz. In

2012, the group entered South America and West

Africa markets.

license to bid”. Being located in Malaysia with a many repeat clients such as

Bumi, Perdana, Nam Cheong is benefitting from the local content requirement.

Since 2007, Nam Cheong already sold 17 vessels to Bumi and 12 vessels to

Perdana excluding the recent 2 x AWB. This is the kind of “Kampung bond” you

will still find in Malaysia today. Of course the primary driver is still

Petronas huge Capex plans going forward. Nam Cheong also established a

solid client relationships with International OSV players. They are Tidewater (one

of the largest OSV owners in

the world), Europe-based Vroon

and Middle East-based Topaz. In

2012, the group entered South America and West

Africa markets.

Support from PRC Outsource Shipyards

Nam Cheong BTS business make up >70% of its revenue today. Most of

the vessels were outsourced to China yards in Fujian – Fujian Southeast,

Fujian Mawei and Xiamen Shipbuilding. The outsourcing strategy allow it to have

more free cash flow in its speculative new builds. It also put the risk of the leverage

to the PRC yards instead. Nam

Cheong generally pays

30% upfront and

70% on delivery for

its newbuilding programme.

Hence, the PRC yards are actually financing the construction of the vessels.

Nam Cheong’s low operating leverage is reflected in its selling, general and

admin expenses, which averaged 6% of sales over the past three years.

the vessels were outsourced to China yards in Fujian – Fujian Southeast,

Fujian Mawei and Xiamen Shipbuilding. The outsourcing strategy allow it to have

more free cash flow in its speculative new builds. It also put the risk of the leverage

to the PRC yards instead. Nam

Cheong generally pays

30% upfront and

70% on delivery for

its newbuilding programme.

Hence, the PRC yards are actually financing the construction of the vessels.

Nam Cheong’s low operating leverage is reflected in its selling, general and

admin expenses, which averaged 6% of sales over the past three years.

Why Fujian shipyards?

Nam Cheong’s Chairman, Datuk Tiong Su Kouk is the Honorary Life President

of the World Federation of Fuzhou Association and has his roots in Fujian

province in China with exceptional good relationship with the Fujian local

government. Today Nam Cheong is one of the biggest investors in the province

with all the vessels built there over the years.

of the World Federation of Fuzhou Association and has his roots in Fujian

province in China with exceptional good relationship with the Fujian local

government. Today Nam Cheong is one of the biggest investors in the province

with all the vessels built there over the years.

Another thing you may

not know is “People with Fujian Roots value relationships and display great

loyalty to their close ones”. I have roots from Fujian too! Hehe!

not know is “People with Fujian Roots value relationships and display great

loyalty to their close ones”. I have roots from Fujian too! Hehe!

Efficiency due to Repeat Vessel Design

Unlike other PRC shipyards that often have quality and timely deliveries

problems, these three yards are very specialized in its shipbuilding programs

and often produce vessels of much higher quality and very timely deliveries.

problems, these three yards are very specialized in its shipbuilding programs

and often produce vessels of much higher quality and very timely deliveries.

The reason is simple. Since Nam Cheong only build a niche of vessels in

the shallow water range, these shipyards tend to only build “Repeat Design”

vessels, and “Practice

Makes Perfect!” since Nam Cheong had

chunked out a remarkable more than 50 vessels from these Chinese yards.

the shallow water range, these shipyards tend to only build “Repeat Design”

vessels, and “Practice

Makes Perfect!” since Nam Cheong had

chunked out a remarkable more than 50 vessels from these Chinese yards.

Why OSV Owners not

order direct from PRC yards?

order direct from PRC yards?

Most of the China PRC yards are state-owned and do not or cannot

undertake speculative builds. This is one major reason why OSV owners choose to

go through Nam Cheong rather than directly approach the PRC yards. Moreover Nam

Cheong has an experience team of project and design staffs located in Singapore. Being located in Singapore offshore hub, means

direct access to International clients and major equipment suppliers, with

better communication channels compared to PRC. In addition, Nam Cheong maintains

a supervisory project teams on the ground to manage the shipbuilding process

and ensure its quality and timely delivery. By buying direct from Nam Cheong,

OSV owners does not have to bear the construction and financial risk and hassle

of project management in dealing directly with PRC yards.

undertake speculative builds. This is one major reason why OSV owners choose to

go through Nam Cheong rather than directly approach the PRC yards. Moreover Nam

Cheong has an experience team of project and design staffs located in Singapore. Being located in Singapore offshore hub, means

direct access to International clients and major equipment suppliers, with

better communication channels compared to PRC. In addition, Nam Cheong maintains

a supervisory project teams on the ground to manage the shipbuilding process

and ensure its quality and timely delivery. By buying direct from Nam Cheong,

OSV owners does not have to bear the construction and financial risk and hassle

of project management in dealing directly with PRC yards.

How Nam Cheong Weathered GFC and Recovers so Quickly

Fundamentals of Oil and Gas industry

The fundamentals of the oil and gas industry were sound even during

the GFC of 2008-09. To me the chaotic situations in 2008/09 are a combination

of over-optimism in the O&M industry and the

finance-tightening by credit institutions.

the GFC of 2008-09. To me the chaotic situations in 2008/09 are a combination

of over-optimism in the O&M industry and the

finance-tightening by credit institutions.

From the above charts, we can see that in fact vessel sales did not stop during the GFC. Companies like Nam Cheong and Coastal Contracts (M’sia) is

maintaining its revenue growth in years thereafter.

maintaining its revenue growth in years thereafter.

Effective BTS strategy

Having already mentioned earlier, Nam Cheong BTS model effectively

transfer the risk to the Chinese yards. During the crisis, demand of vessels is

low but Nam Cheong simply orders fewer vessels from the PRC yards and does not

have to bear the cash operating costs and depreciation charges unlike Otto

Marine and Jaya Holdings who build vessels in their own yards in Batam and Singapore.

transfer the risk to the Chinese yards. During the crisis, demand of vessels is

low but Nam Cheong simply orders fewer vessels from the PRC yards and does not

have to bear the cash operating costs and depreciation charges unlike Otto

Marine and Jaya Holdings who build vessels in their own yards in Batam and Singapore.

Strong Relationship – Clients, Shipyards & Suppliers

It is widespread knowledge in the industry what Nam Cheong treats its

business associates with respect and trust for the benefit of all. Probably

from the roots of its Chairman Datok Tiong, they also value loyalty and

friendship aside from pure business reasons. This is one of the reasons why it manages

to have 67% of its business from repeat clients. Beside its clients, Nam Cheong

also maintains a group of loyal suppliers, based on long term working

partnerships. This is unlike other shipbuilders who only select the yards or

equipment suppliers solely from a profit point of view, changing from one supplier

to another frequently. It is this loyalty of Nam Cheong that trades many return

favors from suppliers, lending them support in cashflow, to tide through the most

difficult periods of the GFC.

business associates with respect and trust for the benefit of all. Probably

from the roots of its Chairman Datok Tiong, they also value loyalty and

friendship aside from pure business reasons. This is one of the reasons why it manages

to have 67% of its business from repeat clients. Beside its clients, Nam Cheong

also maintains a group of loyal suppliers, based on long term working

partnerships. This is unlike other shipbuilders who only select the yards or

equipment suppliers solely from a profit point of view, changing from one supplier

to another frequently. It is this loyalty of Nam Cheong that trades many return

favors from suppliers, lending them support in cashflow, to tide through the most

difficult periods of the GFC.

Rolf’s Views

I like the fact that Nam Cheong is able to recover so quickly from the

GFC. This is even at the back of achieving remarkable growth of more than 40%

yoy since FY2011.

GFC. This is even at the back of achieving remarkable growth of more than 40%

yoy since FY2011.

The lesson from GFC also means better adaptability in case of

unprecedented events happening again. Even if there are adverse market impacts resulting from lower OSV

prices, such a situation will have a delayed impact (1-2 years) on revenues and

earnings.

unprecedented events happening again. Even if there are adverse market impacts resulting from lower OSV

prices, such a situation will have a delayed impact (1-2 years) on revenues and

earnings.

Till date, I cannot find any other companies in the world that has

similar the niche. Nam Cheong BTS business model though risky is very well

managed with proven track records even during the crisis.

similar the niche. Nam Cheong BTS business model though risky is very well

managed with proven track records even during the crisis.

Below is Nam Cheong stellar performance for the past few years.

Source: Nam Cheong

website

website

Nonetheless, the risk of BTS is still eminent. Nam Cheong business will not be spare from a sudden change

in macroeconomic landscape resulting from depressed oil and OSV prices and an unprecedented

credit crunch.

in macroeconomic landscape resulting from depressed oil and OSV prices and an unprecedented

credit crunch.

Related Posts: