Come across a letter today from Citibank, offering 8x credit limit of monthly

income. I am surprised and wonder if this credit ease makes any financial sense.

Few weeks ago, I was asked by a client to provide financial credit report of my

company from Dun and Bradstreet for a project. These two incidents lead to curiosity

on my very own personal credit ratings.

income. I am surprised and wonder if this credit ease makes any financial sense.

Few weeks ago, I was asked by a client to provide financial credit report of my

company from Dun and Bradstreet for a project. These two incidents lead to curiosity

on my very own personal credit ratings.

I then come to know that we can actually buy our personal credit report from

the Credit Bureau of Singapore (CBS). Call me ignorant, but it is something I

never really pay much attention to previously.

the Credit Bureau of Singapore (CBS). Call me ignorant, but it is something I

never really pay much attention to previously.

Here is the website www.creditbureau.com.sg

For S$6.42, you can purchase your own Credit report using your singpass via electronic payment.

Your credit report is a record of your credit payment history

compiled from different credit providers. CBS will provide credit data to its

members (credit providers such as banks etc) to help them to determine whether or not the person

applying for credit is a good credit risk. Examples of credit applications includes credit card, motor vehicle loan, housing loan etc. In doing this, lenders can make

better lending decisions quickly and objectively.

compiled from different credit providers. CBS will provide credit data to its

members (credit providers such as banks etc) to help them to determine whether or not the person

applying for credit is a good credit risk. Examples of credit applications includes credit card, motor vehicle loan, housing loan etc. In doing this, lenders can make

better lending decisions quickly and objectively.

Attach to each Credit Report is a

Credit Score. A Credit Score is a number used by lenders as an indicator of how

likely an individual is to repay his debts and the probability of going into

default. It is an independent assessment of the individual’s risk as a credit

applicant.

A CBS Credit Score is a

four-digit number based on your past payment history on your loan accounts.

four-digit number based on your past payment history on your loan accounts.

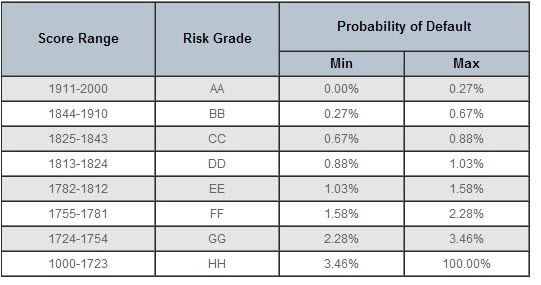

The score range from 1000 to

2000, where individuals scoring 1000 have the highest likelihood of defaulting

on a payment, whereas those scoring 2000 have the lowest chance of reaching a

delinquency status. Together with the score, the risk grade and risk grade

description are provided.

2000, where individuals scoring 1000 have the highest likelihood of defaulting

on a payment, whereas those scoring 2000 have the lowest chance of reaching a

delinquency status. Together with the score, the risk grade and risk grade

description are provided.

Your credit score is just one

factor used in the application process. Other factors apart from your credit

report, such as your annual salary, length of employment, bankruptcy/litigation

information, number of credit facilities may also be taken into consideration

by lenders during a loan application. Below is a table describing Credit

Score.

factor used in the application process. Other factors apart from your credit

report, such as your annual salary, length of employment, bankruptcy/litigation

information, number of credit facilities may also be taken into consideration

by lenders during a loan application. Below is a table describing Credit

Score.

My Credit Score

My credit score is 2000 with an AA

rating. This is the maximum possible score with a 0.27% chance of defaulting

loans.

rating. This is the maximum possible score with a 0.27% chance of defaulting

loans.

I was not surprise to have a high

credit rating, but maximum score still left my eyes and mouth wide open for a while. I thought, I will have to sing some praises to myself for maintaining a 100% clean credit records.

This may be one of the reasons why I

received so many telemarketing calls on loan offerings! Below you can find extract of my credit report.

credit rating, but maximum score still left my eyes and mouth wide open for a while. I thought, I will have to sing some praises to myself for maintaining a 100% clean credit records.

This may be one of the reasons why I

received so many telemarketing calls on loan offerings! Below you can find extract of my credit report.

Also Did you know…..

Related

Posts:

Posts:

Nice information, many thanks to the author. It is incomprehensible to me now, but in general, the usefulness and significance is overwhelming. Thanks again and good luck!

Productivity Innovation Credit

In fact, each and every lender rates you according to their own rules and if you get rejected by one lender, it does not mean that all other lenders would reject you as well.

Chexsystems free banks in New Mexico

With pre approval on your bad credit car loans, you are aware of the pre-set amount and thus it becomes possible for you to narrow down your search and look out for cars that can practically be bought within your limited budget. Credit Repair

With just about everyone having a blog, it is becoming much easier to see what other people went through with a particular company or service. GHS Solutions

This comment has been removed by the author.

This comment has been removed by the author.

Your business obliges you to keep fundamental contacts with the goal that you can utilize them at the correct time. Cost Business

I am actual blessed to read this article.thanks for giving us this advantageous information.I acknowledge this post.I would like to request you that please keep posting such type of informatics blog..How to Improve Credit Score

Interest rates will vary, in general, according to Federal Funds rate (the rate banks charge each other to borrow money) but the specific rate a lender will offer you will depend largely on your credit rating. cash 57

This comment has been removed by the author.

Great explination to the point, As we are sharing same interest so here is my guide on 8 ways to improve my credit score in 2018 just check this out and see if there are any possible mention on your feature coming article.

Eventually, the credit report is viewed as a statement or report of an individual's ability to pay back a debt, and is the key tool to access and grant credit.Hdfc Netbanking Login

I would like to express my appreciation to you just for rescuing me from this type of instance. Just after surfing around through the world-wide-web and finding concepts which were not beneficial, I assumed my life was gone. Being alive devoid of the solutions to the issues you've sorted out as a result of this short post is a crucial case, as well as the ones that might have badly damaged my entire career if I had not encountered your web page. Your primary understanding and kindness in maneuvering everything was invaluable. I'm not sure what I would have done if I had not encountered such a subject like this. I can now look forward to my future. Thanks so much for your expert and result oriented help. I won't hesitate to endorse your web sites to any person who would need assistance on this problem.

credit repair

The best and clear News is very much imptortant to us. buro de credito

You’ve really written a very good quality article here. Thank you very much buro de credito

This site is really a walk-through for all of the information you wanted about it and didn’t know who to question. Glimpse here, and you’ll certainly discover it. buy Instagram likes

it is really great to get government jobs because the government can give you a good job security;; Lucky patcher apk

Hi there! Someone in my Myspace group shared this website with us so I came to give it a look. I’m definitely enjoying the information. I’m bookmarking and will be tweeting this to my followers! Wonderful blog and fantastic design and style. Miss Temperature measurement acim

You actually make it seem so easy with your presentation but I find this matter to be really something which I think I would never understand. It seems too complex and very broad for me. I am looking forward for your next post, I will try to get the hang of it! second chance checking fifth third bank

I have read your blog it is very helpful for me. I want to say thanks to you. I have bookmark your site for future updates. fastusacashloan24x7.com no job verification payday loan

The blog depicts how hard the writer has worked on this.

no credit check loans direct lenders

The main reason naive customers obtain used through this particular rip-off happens because the actual credit score restore support doesn't completely clarify exactly what they're becoming requested to complete. Generally they do not actually understand that this isn't the lawful means to fix their own credit score restore difficulties. End up being hesitant in the event that any kind of credit score restore support guarantees a brand new credit report or even clean credit rating. credit repair services

I really appreciate your work which you have shared here about the Credit Report. The article you have shared here is very informative and the points you have mentioned are very helpful. Thank you so much. Auscreditconsultants is the best Credit Repair Company in Australia.

That is the excellent mindset, nonetheless is just not help to make every sence whatsoever preaching about that mather. Virtually any method many thanks in addition to i had endeavor to promote your own article in to delicius nevertheless it is apparently a dilemma using your information sites can you please recheck the idea. thanks once more. Microsoft Dynamics 365 Sales Credit Card Processing

상품권 매입 Thanks for the blog loaded with so many information. Stopping by your blog helped me to get what I was looking for.

You there, this is really good post here. Thanks for taking the time to post such valuable information. Quality content is what always gets the visitors coming. Best Darkweb Carding Forum and Hacking forum

Credit cards may be the easiest way to get a standby line of revolving credit, always available when you need it, but it can also be the fastest way to get mired in credit card debt. credit cards europe

DIY Credit Repair Kit

Hai to get create new unique links for instagram likes and followers.

Every month credit card organization will send month to month articulation to credit card clients. debt relief companies

how to get and also buy instalikes

You will receive a statement with all of the proper coding that you will have for your HSA administrator if you wish a refund later. Selling Cash Discount Program

The credit card machines are a great way to make life easier for customers and also to make an impact, whether you are a well established company with good reputation or are a completely new business. These machines have made it possible for many Auto Repair credit card processing and organisations to accept payments quickly and securely, which is great news for people who can't pay by cash all the time.