Most adult Singaporean will know that Temasek Holdings is the investment

company owned by the Government of Singapore. It is also well-known that the company

is run by our Prime Minister’s wife Ho Ching operating as the Executive

Director and CEO of the company.

company owned by the Government of Singapore. It is also well-known that the company

is run by our Prime Minister’s wife Ho Ching operating as the Executive

Director and CEO of the company.

Aside from knowing what Temasek does and who runs it, how much do you

know about Temasek Holdings?

know about Temasek Holdings?

As a Singaporean and avid investor, I feel compel to find out more about

Temasek portfolio and performance. Let us then take a closer look into one of our

country’s largest investment company.

Temasek portfolio and performance. Let us then take a closer look into one of our

country’s largest investment company.

Company Brief

Temasek

Holdings is owned by Government of Singapore Investment Corporation (GIC), a sovereign

wealth fund that manages Singapore foreign reserves. GIC’s assets stand at US$330b.

Holdings is owned by Government of Singapore Investment Corporation (GIC), a sovereign

wealth fund that manages Singapore foreign reserves. GIC’s assets stand at US$330b.

As many may have

misunderstood, Temasek Holdings is neither a

statutory board nor a government agency. It operates under the provisions of

the Singapore Companies Act and has its own board of directors and a management team. It pays taxes

to tax authorities and distributes dividends

to its shareholder, the Singapore Ministry of Finance.

misunderstood, Temasek Holdings is neither a

statutory board nor a government agency. It operates under the provisions of

the Singapore Companies Act and has its own board of directors and a management team. It pays taxes

to tax authorities and distributes dividends

to its shareholder, the Singapore Ministry of Finance.

Incorporated in 1974,

Temasek has many global offices and a multinational team of over 450 people.

This year, it opened a New York Office. Chairman of Temasek is ex-minister Lim

Boon Heng. Temasek owns and manages a net portfolio of S$223b (US$177b)

as of Mar 2014, mainly in Singapore and Asia. Its portfolio covers a broad

spectrum of sectors including financial services, telecommunications,

media and technology, transportation and industrials, life sciences,

consumer, real estate, as well as energy and resources.

Temasek has many global offices and a multinational team of over 450 people.

This year, it opened a New York Office. Chairman of Temasek is ex-minister Lim

Boon Heng. Temasek owns and manages a net portfolio of S$223b (US$177b)

as of Mar 2014, mainly in Singapore and Asia. Its portfolio covers a broad

spectrum of sectors including financial services, telecommunications,

media and technology, transportation and industrials, life sciences,

consumer, real estate, as well as energy and resources.

Temasek is one of a

few global firms assigned with the highest overall corporate credit

ratings of “AAA” by Standard

& Poor’s and “Aaa”

by Moody’s. It has also attained

perfect quarterly scores on the

Linaburg-Maduell Transparency Index, a measure of the openness of

government-owned investment funds.

few global firms assigned with the highest overall corporate credit

ratings of “AAA” by Standard

& Poor’s and “Aaa”

by Moody’s. It has also attained

perfect quarterly scores on the

Linaburg-Maduell Transparency Index, a measure of the openness of

government-owned investment funds.

Aside from

investments, Temasek is also heavily involved in community and charitable

activities.

investments, Temasek is also heavily involved in community and charitable

activities.

Performance

Portfolio

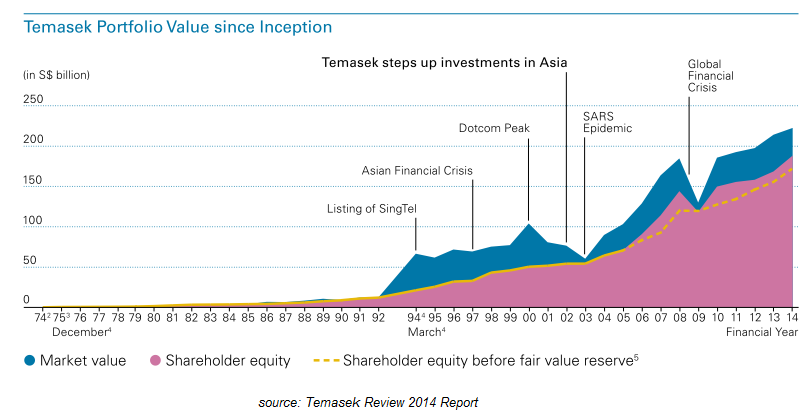

Temasek’s

portfolio grows from S$354m in 1974 to a Portfolio of S$223b

today. In the last ten years,

portfolio has more than doubled from S$90b in Mar 2004 to S$223b in Mar 2014.

portfolio grows from S$354m in 1974 to a Portfolio of S$223b

today. In the last ten years,

portfolio has more than doubled from S$90b in Mar 2004 to S$223b in Mar 2014.

Shareholder

Equity

Equity

Group shareholder equity is

S$187b,

up S$122b from 10 years ago. Over 70% of

Temasek’s portfolio was held in liquid and listed assets.

S$187b,

up S$122b from 10 years ago. Over 70% of

Temasek’s portfolio was held in liquid and listed assets.

Net Profits

Group net profit in the

last year is steady at S$11b, above group

average of net profit S$10b a year.

last year is steady at S$11b, above group

average of net profit S$10b a year.

Total Shareholder Return (TSR)

TSR in the year is 1.5% in Singapore dollars mainly due to weakness

in key markets in Asia. Compounded annual return over last 10

years was 9%. Longer

term 20 year TSR was 6%. Since inception in 1974, compounded annual return

is 16%. TSR excludes

capital injections from shareholder and includes dividends paid to our

shareholder.

in key markets in Asia. Compounded annual return over last 10

years was 9%. Longer

term 20 year TSR was 6%. Since inception in 1974, compounded annual return

is 16%. TSR excludes

capital injections from shareholder and includes dividends paid to our

shareholder.

Does not drawn

on Past Reserves

on Past Reserves

Temasek finance their investments primarily using

dividends from their portfolio companies and divestment proceeds. The company

also claimed that they make sure its Total Reserves equal or exceed its past

reserves, such that there is no draw on past reserve. This includes making sure

that every divestment is done at a fair market value.

dividends from their portfolio companies and divestment proceeds. The company

also claimed that they make sure its Total Reserves equal or exceed its past

reserves, such that there is no draw on past reserve. This includes making sure

that every divestment is done at a fair market value.

Portfolio

Temasek Portfolio comprised mostly equities. The top three

countries in our portfolio, based on the underlying assets, are Singapore, China and

Australia at 31%, 25% and 10% respectively, as at 31 March 2014. Temasek underlying exposure to North

America and Europe grew to over 14%, up from

12% the previous year.

countries in our portfolio, based on the underlying assets, are Singapore, China and

Australia at 31%, 25% and 10% respectively, as at 31 March 2014. Temasek underlying exposure to North

America and Europe grew to over 14%, up from

12% the previous year.

Source: Temasek website

Last year,

Temasek made S$24b in new investments, while divesting S$10b having a net S$14b investments. This is very active and doubles the average annual net

investment level of S$7b for the past decades.

Temasek made S$24b in new investments, while divesting S$10b having a net S$14b investments. This is very active and doubles the average annual net

investment level of S$7b for the past decades.

Half of the

investments were in Asia and two-fifths in Europe and North America. In the last 10 years, Temasek invested almost S$180b and divested nearly

S$110b i.e. net S$80b.

investments were in Asia and two-fifths in Europe and North America. In the last 10 years, Temasek invested almost S$180b and divested nearly

S$110b i.e. net S$80b.

Mr Lee Theng Kiat President of

Temasek commented, “Half of our new investments last year were in Asia, as

weakness in the growth markets gave us various opportunities to add to the

positions we like. Europe and North America accounted for about 40% of our new

investments. In absolute dollars, investments into these two regions increased

by 60% compared to the previous year.”

Temasek commented, “Half of our new investments last year were in Asia, as

weakness in the growth markets gave us various opportunities to add to the

positions we like. Europe and North America accounted for about 40% of our new

investments. In absolute dollars, investments into these two regions increased

by 60% compared to the previous year.”

Sectors

Temasek’s existing underlying assets are spanned across six major

sectors.

sectors.

Taking the lead is Financial Services at 30% of Temasek total portfolio

with major holdings in DBS, China Construction Bank and Standard Chartered each

worth more than S$10b.

with major holdings in DBS, China Construction Bank and Standard Chartered each

worth more than S$10b.

Telecoms, Media and Technology come next at 23% of total portfolio of

which more than S$30b holding comes from Singtel’s 52% stake. Major stakes in

other Singapore companies include ST Telemedia, Mediacorp, and STATs ChipPAC.

The company also has major stakes in China Alibaba, India Bharti Airtel,

Thailand Intouch and USA Markit.

which more than S$30b holding comes from Singtel’s 52% stake. Major stakes in

other Singapore companies include ST Telemedia, Mediacorp, and STATs ChipPAC.

The company also has major stakes in China Alibaba, India Bharti Airtel,

Thailand Intouch and USA Markit.

The Transportation & Industrial key portfolios includes mostly of Singapore

companies such as PSA, Singapore Power, SIA, Sembcorp, Keppel Corp, NOL, SMRT

and one German company Evonik.

companies such as PSA, Singapore Power, SIA, Sembcorp, Keppel Corp, NOL, SMRT

and one German company Evonik.

Major stakes in Life Science, Consumer & Real Estate sector includes

Mapletree Investments and CapitaLand with holdings worth approx. 8.3b and 4.8b

respectively.

Mapletree Investments and CapitaLand with holdings worth approx. 8.3b and 4.8b

respectively.

Energy and Resource portfolio comprise of more than USD1b holdings in USA

Fortune 500, The Mosaic Company, a major producer of fertiliser, EUR2b

investments in Spain oil company Repsol SA, and S$2b stake in our very own

Pavillion Energy.

Fortune 500, The Mosaic Company, a major producer of fertiliser, EUR2b

investments in Spain oil company Repsol SA, and S$2b stake in our very own

Pavillion Energy.

Source: Temasek website

The top three sectors for investments during the past financial year were Financial services, Life sciences and Energy.

Financial

- AIA: Increase holdings to over 3.5%

- Industrial and Commercial Bank of China (ICBC): increase holdings in to

2.2%. - Lloyds Banking Group: Taken 1.1% position

Life Science

- Gilead Sciences, a major developer of treatments for cancer HIV and

other infectious diseases. Invested almost US$1b. - Thermo Fisher Scientific, a provider of laboratory equipment and

consumables. Invested US$500m.

Energy

- BG Group, a UK-listed oil and gas company. Invested £235 million.

- Pavilion Energy, a Singapore company which focuses on LNG sourcing,

supply and solutions. Invested S$2b. - Seven Energy, an oil and gas producer in Nigeria. Invested US$150m.

Consumer sector

- A.S. Watson purchased from Hutchison Whampoa for US$5.7b invested worth

24.95% stake. - Olam acquisition worth S$5.4b.

Divestments during the year included part of Temasek’s stakes in Bharti Telecom

and Seoul Semiconductor. The company also completely exited investments in

Tiger Airways, Cheniere Energy and Youku-Tudou.

Summary

Temasek started 40

years ago and had since achieved spectacular portfolio growth from S$354m to

S$223b. This means that S$1k investment in 1974, will be worth S$630k today.

years ago and had since achieved spectacular portfolio growth from S$354m to

S$223b. This means that S$1k investment in 1974, will be worth S$630k today.

As Singaporean, I am so glad that Singapore started investing in the early years after independence and attained such commendable results. This is definitely an important lesson to advocate individual Singaporean to start investing early as well.

Temasek says that

their journey has just begun. I consider my investment journey also just begun.

their journey has just begun. I consider my investment journey also just begun.

How about yours?

As Singaporean and CPF account holder, I benchmark myself against Temasek and GIC long-term investment return LOL!

Hi Uncle CW8888,

Thanks for the comments. Me too a Singaporean and CPF holder. I definitely do not mind a Compound return of 16% for my portfolio. LOL

Thanks, Rolf.