I met a friend for lunch this week. He works in a company that supplies equipment to Liftboats. During the conversation, he mentioned the growing number of inquiries of Liftboats lately.

Is Liftboats leading the pack in the Offshore Oil and Gas industry?

Before

we examine the demand and supply dynamics of Liftboats, we must first understand the energy

outlook within the South East Asia (SEA).

we examine the demand and supply dynamics of Liftboats, we must first understand the energy

outlook within the South East Asia (SEA).

Energy

Outlook for South East Asia

Outlook for South East Asia

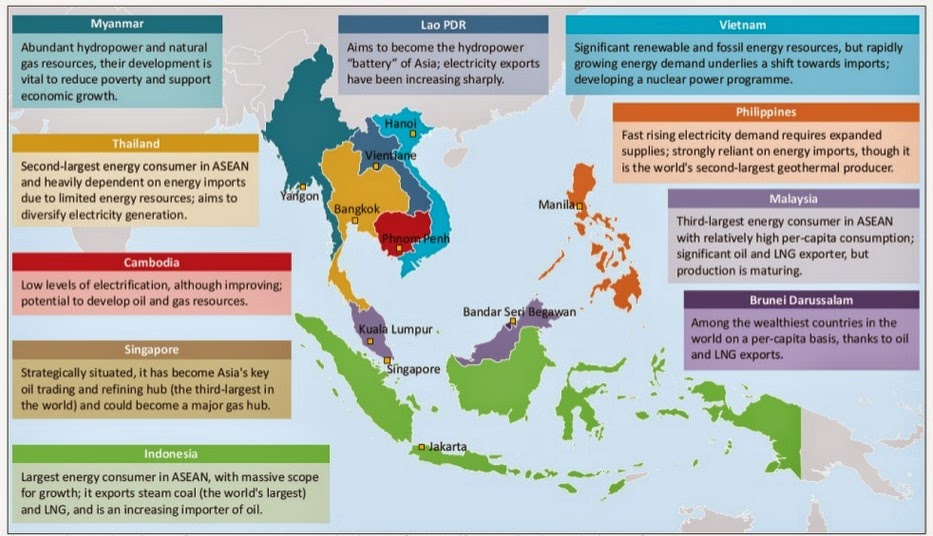

Below is an energy landscape of oil and gas

countries in SEA. Indonesia, Malaysia and Brunei lead the oil and gas

production in SEA while potential growth lies in countries such as Vietnam and Myanmar.

countries in SEA. Indonesia, Malaysia and Brunei lead the oil and gas

production in SEA while potential growth lies in countries such as Vietnam and Myanmar.

Rising Energy Consumption

Over the years, SEA had a growing thirst of

energy due to sustained economical and social development. Although SEA has

rich resources of energy, many countries are relying on imports due to the

supply of energy unable to catch up with rapidly rising demand. Indonesia and

Malaysia are the two largest oil and gas exporter in SEA. Since

financial crisis in 1998, Indonesia had under-invest in its oil and gas

exploration. Major oil and gas fields are drying up and are not replaced by new

ones, due to a lack of exploration. Similarly, Malaysia has seen consumption grow

while production has been falling over the past decade. This leaves smaller

volumes of oil available for exports. Petronas had promised to ramped up its capex

to minimum RM300b from 2011 to 2015.

energy due to sustained economical and social development. Although SEA has

rich resources of energy, many countries are relying on imports due to the

supply of energy unable to catch up with rapidly rising demand. Indonesia and

Malaysia are the two largest oil and gas exporter in SEA. Since

financial crisis in 1998, Indonesia had under-invest in its oil and gas

exploration. Major oil and gas fields are drying up and are not replaced by new

ones, due to a lack of exploration. Similarly, Malaysia has seen consumption grow

while production has been falling over the past decade. This leaves smaller

volumes of oil available for exports. Petronas had promised to ramped up its capex

to minimum RM300b from 2011 to 2015.

Below

is a chart from IEA showing ASEAN growing demand of energy.

is a chart from IEA showing ASEAN growing demand of energy.

Maturing

Oil Fields

Oil Fields

The

decline in energy production in SEA aside from rising consumption is a result of large numbers of maturing fields, particular

the ones in shallow waters. Many oil platforms are already old and required

maintenance/upgrade such as replacement of tubings, valves, pumps that may be malfunctioned.

Some very old platforms are also required to be removed, while new ones are to added. Liftboats are built specifically for this purpose.

decline in energy production in SEA aside from rising consumption is a result of large numbers of maturing fields, particular

the ones in shallow waters. Many oil platforms are already old and required

maintenance/upgrade such as replacement of tubings, valves, pumps that may be malfunctioned.

Some very old platforms are also required to be removed, while new ones are to added. Liftboats are built specifically for this purpose.

Definition of LiftBoats

A liftboat is a self-elevating,

self-propelled (maneuvering capabilities) vessel equipped with at least

one crane and with open deck space that can be used for support

of various offshore activities. Liftboats are commonly used to perform maintenance on oil and

gas well platforms, normally for shallow water field

services. Its applications include:

self-propelled (maneuvering capabilities) vessel equipped with at least

one crane and with open deck space that can be used for support

of various offshore activities. Liftboats are commonly used to perform maintenance on oil and

gas well platforms, normally for shallow water field

services. Its applications include:

- Oil well intervention activities (e.g. wireline and coiled tubing)

- Maintenance and repairs of offshore platforms

- Upgrading/Construction of offshore platforms

- Removal of old platforms

- Accommodation for construction and service crews

Jack up Drilling Rigs that Keppel and Sembmarine build differs from Liftboats, in that they posses drilling capabilities and without

self-propulsion.

self-propulsion.

Examples of Self-Elevating Units

Liftboats is assume to have depreciation life = 25 years and can remain in service for 19 years, while service rigs having depreciation life = 10-20 years that can serve for 9.5 years. These assumptions are conservative though.

SEUs Liftboats owners

/ Builders

/ Builders

Ezion is one of the largest Liftboats owner in the world and listed in SGX. The company is a direct beneficiary from the increasing demand of SEUs that seen its earnings exploded from S$13mil in 2009 to S$160mil in 2013. Share price had also rose from 0.09c in 2009

to S$2.20 today achieving a market cap of S$2.6bil.

to S$2.20 today achieving a market cap of S$2.6bil.

Swissco a company traditionally in offshore support service support, had also acquired Scott & English recently to jointly own SEUs with Ezion. Other owners includes Ezra’s EMAS who also owns two modern and Liftboats.

Aside from the Singapore players mentioned, currently almost all major

liftboat players are from USA except for Gulf Marine Services base in Middle

East.

liftboat players are from USA except for Gulf Marine Services base in Middle

East.

The SEUs owned by Ezion and EMAS are almost all constructed in Triyards, although Ezion has awarded its first Chinese yard order Mar this year. Triyards also have their own design

of SEUs, BH450 series proprietary-designed 450ft (approx 130m) leg length

SEUs. The BH450 is reported to be the world largest Liftboat to be delivered by End 2Q2014. As of end 2013, Triyards had delivered 6 SEUs with a backlog of 3-4 SEUs. Lamprell based in UAE is the biggest contributors in Middle East.

of SEUs, BH450 series proprietary-designed 450ft (approx 130m) leg length

SEUs. The BH450 is reported to be the world largest Liftboat to be delivered by End 2Q2014. As of end 2013, Triyards had delivered 6 SEUs with a backlog of 3-4 SEUs. Lamprell based in UAE is the biggest contributors in Middle East.

Advantages of LiftBoats

Niche

It is very niche in its operation particularly for maintenance of

platforms. The concept of liftboat servicing

platform is uncommon in the past.

platforms. The concept of liftboat servicing

platform is uncommon in the past.

Before, it is more common to use jack up drill rigs, derrick barges or

workboats to service the platforms. These vessels are often multi-purpose with

other functionality such as drilling, pipelaying, construction or other

activities.

workboats to service the platforms. These vessels are often multi-purpose with

other functionality such as drilling, pipelaying, construction or other

activities.

Due to rising numbers of old platforms in recent years, it is more

efficient to utilise a dedicated vessel to perform the dedicated work of

maintenance, upgrading or removing of platforms. Liftboats is effectively a

low-cost alternative for a wide array of offshore jobs– construction,

work-over, maintenance and platform removals.

efficient to utilise a dedicated vessel to perform the dedicated work of

maintenance, upgrading or removing of platforms. Liftboats is effectively a

low-cost alternative for a wide array of offshore jobs– construction,

work-over, maintenance and platform removals.

No mobilisation cost

For example, a jack up and tender assist drilling barge is normally

built together with drilling capability. It will be very expensive to charter

them for service of platforms compared to a liftboat. Moreover jack up rigs and derrick barges

are not self-propelled and required mobilisation services of towing and mooring

from offshore support vessels such as AHTS and Tug boats. This will mean

additional charter charges.

built together with drilling capability. It will be very expensive to charter

them for service of platforms compared to a liftboat. Moreover jack up rigs and derrick barges

are not self-propelled and required mobilisation services of towing and mooring

from offshore support vessels such as AHTS and Tug boats. This will mean

additional charter charges.

Safer to work in harsh weather

Then you may consider a workboat that is self-propelled with a large

capacity crane. However a workboat is without the Jack up legs and cannot be too close

to the platforms since it require mooring services. Also during bad wave

condition, a workboat has to stop working because of stability issue due to the

wave movement. In contrast, liftboat is more stable even during adverse weather

conditions. It can jack itself above the maximum wave height and continue to

perform its work unaffected even up to water depths of 220 feet.

capacity crane. However a workboat is without the Jack up legs and cannot be too close

to the platforms since it require mooring services. Also during bad wave

condition, a workboat has to stop working because of stability issue due to the

wave movement. In contrast, liftboat is more stable even during adverse weather

conditions. It can jack itself above the maximum wave height and continue to

perform its work unaffected even up to water depths of 220 feet.

Above is an example of a tender assist drilling barge working alongside a fix

platform, subject to weather conditions and requires towing and mooring assist

services from OSV. On the contrary, a Liftboat shown below is jacked up and stable, unaffected by the wave or weather conditions.

platform, subject to weather conditions and requires towing and mooring assist

services from OSV. On the contrary, a Liftboat shown below is jacked up and stable, unaffected by the wave or weather conditions.

Price and Profitability of LiftBoats

From Triyards presentation, indicative price of each Liftboat

that Ezion owns is approx. US$55-60mil. A typical standard B class design

Keppel Fels 300-350ft Jack up will cost US$180-220mil. A drilling Tender Barge owned by

SapuraKencana will cost US$130mil.

that Ezion owns is approx. US$55-60mil. A typical standard B class design

Keppel Fels 300-350ft Jack up will cost US$180-220mil. A drilling Tender Barge owned by

SapuraKencana will cost US$130mil.

Charter Day Rate for a jack up and tender barge is typically between US$100k to 160k while Day Rate for Liftboat is range between US$40-60k per day, making it more competitive.

Example

PEMEX of Mexico award Ezion a US$150mil for a 7 years bareboat

charter of a liftboat.

charter of a liftboat.

This means Annual revenue = 21.4m (150/7). Assume cost of Liftboat

= 55m. Opex = 0 insignificant due to bareboat charter. Taking into account other cost in project such as manpower, maintenance, survey work, total cost can add up to approx.

30% or more on top of building cost. This work out to be Total Capex = approx. 77m (p.a. = 11m).

= 55m. Opex = 0 insignificant due to bareboat charter. Taking into account other cost in project such as manpower, maintenance, survey work, total cost can add up to approx.

30% or more on top of building cost. This work out to be Total Capex = approx. 77m (p.a. = 11m).

Net Profit Estimate = 21.4 – 11.0 = 10.4m (~50% margin per liftboat per year)

Rolf’s View

Demand

for SEUs in Asia Pacific, Middle East and Africa remains strong, due to aging platforms and increasing offshore construction activity.

for SEUs in Asia Pacific, Middle East and Africa remains strong, due to aging platforms and increasing offshore construction activity.

Market outside America regions are relatively unpenetrated.

- North America has 250 liftboats servicing 3,257 fixed platforms i.e 1 SEU = 13 platforms.

- Southeast Asia (SEA), Middle East and West Africa has 62 SEUs against 3,266 fixed platforms i.e. 1 SEU: 53 platforms.

It is quite

obvious that demand is still robust. The niche in the SEU field will

also benefit companies like Ezion, Ezra, Swissco and Triyards who is already in the business well ahead. The investment in Ezion (over US$100MM) by Tan

Sri Quek Leng Chan (Chairman and CEO of Hong Leong Company) few months back, further

reinforced this view.

Nonetheless, Oil and Gas is a sector that exhibits “high risk high return” trait. The high

capex model of Liftboat leading to high leverage can be potentially dangerous if economy took a turn such as the financial crisis in 2008. Due to high return in the sector, it will potentially attracts more competition not

only from current liftboat owners but also newcomers driving charter rates down. There will also be risk of delay in its building timeliness, especially when

Ezion already start awarding order to Chinese yard.

capex model of Liftboat leading to high leverage can be potentially dangerous if economy took a turn such as the financial crisis in 2008. Due to high return in the sector, it will potentially attracts more competition not

only from current liftboat owners but also newcomers driving charter rates down. There will also be risk of delay in its building timeliness, especially when

Ezion already start awarding order to Chinese yard.

Specifically

for Ezion, it had already grown incredibly to billions of market cap within the

short last few years. Having on of the largest fleets and high leverage will also mean rigidness when things goes wrong. Personally, I prefer smaller company like Swissco or even Triyards

who I reckon have more growth potential with much lower PE and PB ratios.

for Ezion, it had already grown incredibly to billions of market cap within the

short last few years. Having on of the largest fleets and high leverage will also mean rigidness when things goes wrong. Personally, I prefer smaller company like Swissco or even Triyards

who I reckon have more growth potential with much lower PE and PB ratios.

Thank you for reading this article. I will end with an animation of a Liftboat in operation.

Related Post:

the chart on number of liftboats per player is outdated. Hercules Offshore has sold off their US GoM liftboat fleet leaving them with 24.

Testimony of Restoration with the help of Martinez Lexie([email protected] OR +18168926958)..

I have been in financial mess for the past months, I'm a single mum with kids to look after. My name is Renee Joan Rothell, and am from Ridley Park, Pennsylvania. A couple of weeks ago My friend visited me and along our discussion she told me about Mr Martinez Lexie of ( [email protected] ); that he can help me out of my financial situation, I never believed cause I have spend so much money on different loan lenders who did nothing other than running away with my money. She advised, I gave it a try because she and some of her colleagues were rescued too by this Godsent lender with loans to revive their dying businesses and paying off bills. so I mailed him and explain all about my financial situation and therefore took me through the loan process which was very brief and easy.. After that my loan application worth 78,000.00 USD was granted, all i did was to follow the processing and be cooperative and today I am a proud business owner sharing the testimony of God-sent Lender. You can as well reach him through the Company website: http://lexieloans.bravesites.com OR text: +18168926958

FUNDING CIRCLE INC([email protected])

Hello am Nathan Davidson a businessman who was able to revive his dying business through the help of a Godsent lender known as Jason Raymond the CEO of FUNDING CIRCLE INC. Am resident at 1542 Main St, Buffalo, NY.. Well are you trying to start a business, settle your debt, expand your existing one, need money to purchase supplies. Have you been having problem trying to secure a Good Credit Facility, I want you to know that FUNDING CIRCLE INC. is the right place for you to resolve all your financial problem because am a living testimony and i can't just keep this to myself when others are looking for a way to be financially lifted.. I want you all to contact this Godsent lender using the details as stated in other to be a partaker of this great opportunity Email: [email protected] OR Call/Text +14067326622

God Bless Edward Jones Loans for Helping Me In Time Of Need {[email protected]}

Good Day I am Vanessa Cowen from California and i have a broken up business, until i found this company who help me to gain a loan for business, and now i want to used this short medium to congratulate the company for the fast and safe funds they loan to me without any form of delay, i loan 180,000.00USD from the company at a very low interest rate of 2% to save my business and lots more. i first saw their mail on the internet, everyone always give testimony for what they did, so i quickly contacted them and they all did everything for me without stress and my funds was sent to my account within 24hrs, i was surprise and feel glad, now i now have a standard business control agent who help me, now i will advice those who need urgent loan to contact them now via email : {[email protected]} OR Text him +1(307) 217-5388..

Hi Anonymous,

Thanks for the information and update.

Rolf

Qatar shipyard signed the contract of $110m to develop a self-propelled and self-elevating liftboat.Which is the joint venture between Nakilat-Keppel Offshore & Marine.This liftboad can accommodate nearly 130 passengers.The project going to be completed by the end of 2015.

Hi Emily,

Thanks for the info. Seems like liftboat market is starting to get crowded.

Thanks Rolf

your info is very interesting and useful .from Vietnam ,Do Thai Binh,naval archtect

thank you

Hi Binh,

Cam o'n ban! I am happy that it is useful to you.

You work in the oil and gas industry too?

I use to frequent vietnam HCM, Vungtau and Hanoi quite a lot and have many dealings in your country.

Anyway, hope you can share my blog with your friends too.

Thanks, RS

Rolf

Overall, a good article.

1) Ezra does not own any liftboats anymore.

One of them sank in 2008 whilstbeing transported to the North Sea.

The other was a 51% stake which has since been sold and ultimately bought by Ezion earlier this year.

2) Your cost assumptions are not correct.

If Ezion bare boats an SEU, then in terms of OPEX, they do not have manpower, survey of operational costs, other than maintenance costs of keeping the rig in good working condition.

However, there will be depreciation, finance, insurance, etc costs.

3) Triyard's BH450 is a large liftboat but is not the largest of it's kind in the world.

Master marine and Ezion own one of the largest Liftboats (SEUs).

Hi William,

Thanks for the comments and seems like you are an expert in this field. Great to hear your sharing of information.

I wrote this article in June this year. I read at Ezra website that they do own via EMAS then liftboats Lewek Leader and Lifter.

Is it confirm that Ezra (or EMAS) does not own any liftboat anymore???Where can we find the information. Appreciate if you can let the reader know???

For bareboat OPEX, thanks for the enlightenment. OPEX is indeed zero for bareboat charter which I mentioned in the article. I do understand that crew and master cost are not inclusive in bareboat. Manpower cost I mentioned is generalize cost in anyway related to manpower of any kind and not crew and master. Apologies for not being clear.

Agree that finance and depreciation should take into account. But insurance??? Most bareboat I heard, insurance of the vessel is also taken care by the charterer. Is this correct???

For BH450, I written that it was reported to be one of the world largest delivered in 2Q14. Actually it was also widely reported in articles available online. Below article link is one of them. And there are other articles online as well.

http://www.marinelink.com/news/liftboat-delivery-largest370288.aspx

You mentioned Ezion and Master Marine own one of the largest liftboats. You mentioned that BH450 is not one of the largest!

It will be great for me and other reader to know which Liftboat (design) is the largest currently, since you highlighted that BH450 is not the one.

Thank you so much! Look forward to your sharing of information. Great to learn more. 🙂

Rolf

Hi Rolf,

Thank you for your article, just the information I need!

I am wondering where can I find out more about the operation information of the liftboats in each region? like where and how many are in operation in Southeast Asia?

Thank you~

Hi Anonymous,

I do not have the info you requested. If you are really interested, do drop me an email (via my contact tab), and I will try my best to research and if possible send some related info. No promises of success rate though.

Appreciate if you can share with me additional information you have that is not contained in this article too. Thanks.

Cheers, Rolf

ARTICLE WITH THE INFO ON EZRA's LIFTBOAT TITAN 1 THAT SANK WHILST BEING TRANSPORTED TO THE NORTH SEA.

http://www.finanznachrichten.de/nachrichten-2008-10/12142379-ezra-holdings-limited-liftboat-titan-1-027.htm

1) THESE ARE CONSIDERED VERY LARGE JACK UP RIGS/BARGES. Approx 70% to 80% larger than the BH450.

http://www.master-marine.no/about-us/history/

Ezion bought out one of the 2 that was built in Labroy by MasterMarine.

http://www.heavyliftspecialist.com/tag/teras-sunrise/

It will be ready for work in Q1 2015.

2) Search the TRIYARDS site for the information on number of platforms globally and number of self elevating units (SEUs).

if I am not mistaken, one of the presentations should contain the relevant chart or table.

3) I AM NOT AN EXPERT

Actually Rolf, I am not an expert in this field. Just reading up and following events as closely as I can, since I find this sector very interesting (with more growth to come even with OIL at USD60-80).

4) MERGERS & ACQUISITIONS IN THIS SEGMENT IS STARTING

Recently there was a proposed merger between Seafox (Dutch) and MOS (Mid East). Actually the latter took over the former.

They have a combined fleet of 12 jack ups and many are for accommodation.

EZION has 37 units in it's fleet.

4 units are 50% owned

2 units are chartered-in

5) EZRA's LIFTBOAT EXPOSURE

Search for Lewek Lifter and Lewek Leader and check "marinetraffic.com" ….you will see it shows the vessel location of Teras Conquest 1 & 5, that is owned 100% by Ezion.

I suspect there has been a shareholding restructuring recently.

6) INSURANCE costs: I am not the expert and I have a lot to learn here.

Thanks.

Hi William,

Late reply due to a traveling week in China. It is great to share and learn together.

Indeed from Marine Traffic it shows relation of Teras to Lewek. Internet is playing the trick, since if you search Emas Lewek Lifter or Leader, it still show the vessels. Maybe it is outdated, but still reflects that Ezra used to own Liftboats but not anymore. It is also after they sold their shares off from Ezion.

Just curious why Lewek Lifter/Leader showed orange hulls but Teras 1&5 vessel showed blue hulls. Maybe they painted it thereafter. Haha!

MasterMarine is Jack Up Barge. Is Jackup Barge really same as Liftboat? Some says yes, but no 100% proof that they are exactly similar.

For instance, Notation of vessel is different. MasterMarine Jack up Barge is NON self propelled, therefore it is classified as a barge. BH450 is self-propelled therefore a Boat.

BH450 is reported (at my time of writing) that it is the biggest Liftboat of its kind. Refer to http://www.marinelink.com/news/liftboat-delivery-largest370288.aspx .

Pardon that I could not find any information that Titan 1 nor MasterMarine is the largest Liftboat today?

Thanks.

Liftboats and Tender Barges will soon be eclipsed by a new design that eliminates the need for large cranes and the transfer of equipment from the Liftboat or Tender Barge to the Platform or Wellhead. By doing so the new design substantially reduces the amount of NPT (Non Productive Time) and saves the operators, excuse the pun, barrels of money.

Furthermore, as the new design is classed as a MODU/MOU it is able to take hydro carbons on board if required. In fact the new design is set to eliminate Drilling Jack Ups from many of the tasks currently undertaken by them as the new design is able to Run Completions, Well Test, EOR and carry out all the services required for a well right through its life until Plug and Abandon. As well as being classed MODU/MOU it is also a DP2 Harsh Environment Rig able to work in water depths of up to 400 feet.

It has won acclaim by all the numerous service companies in the USA, Europe and Asia who have seen it. All it needs now is for the E&P companies to get on board and take steps to cut operational and maintenance costs.

To find out more visit http://www.cedco.co/theheron/ or email me [email protected]

Rolf,

We are manufacturers of raw water supply systems to liftboats. Our recent contribution was to Seajack's Scylla. You can see in the sea trials video our reels.

Pl. can you contact me on [email protected] as the liftboat market is really of interest to me. We may have some common interests.

Thanks.

Vinod Shirhatti

Director of Business Development

(281)687-3693

[email protected]

Dear all,

Forecasting for Liftboat by 2017 are getting better…pls always share with us.

Can email to me at : [email protected]

http://borneoffshore.weebly.com/contact-us.html

With so many books and articles coming up to give gateway to make-money-online field and confusing reader even more on the actual way of earning money, easy cancel online fax service