Good Bye! My Heart says No, but my Head

says Yes!

says Yes!

My Heart Says…..Keep

Singapore Press

Holdings a.k.a SPH is one of my first stocks purchased when I started trading close to 4 years ago. It is also one of my all time favorite stocks which can be explained as follows.

Holdings a.k.a SPH is one of my first stocks purchased when I started trading close to 4 years ago. It is also one of my all time favorite stocks which can be explained as follows.

I read Business Times

newspapers every morning, and listen to “Kiss 92” FM which is the preset FM

channel in my car. On weekdays, me and wife enjoy strolling at Clementi

Mall after dinner. On weekends, Paragon Orchard is one of my family favorite malls to visit!

Saturday morning is for professional medical/dental services, while Sunday

is reserved for family dinner at Ding Tai Fung or Sushi Teh. After dinner, it

is all heavenly for my 3 year old, fascinated by the playgrounds and Toys R US.

newspapers every morning, and listen to “Kiss 92” FM which is the preset FM

channel in my car. On weekdays, me and wife enjoy strolling at Clementi

Mall after dinner. On weekends, Paragon Orchard is one of my family favorite malls to visit!

Saturday morning is for professional medical/dental services, while Sunday

is reserved for family dinner at Ding Tai Fung or Sushi Teh. After dinner, it

is all heavenly for my 3 year old, fascinated by the playgrounds and Toys R US.

Then you have Stomp

and Razor TV updating me and my wife with all entertainment news and gossips

within this small island. SG CarMart provides me with the latest Car

prices and models. Last year, I also finished

reading SPH published book – “Lee Kuan Yew’s One Man’s View of the World”.

and Razor TV updating me and my wife with all entertainment news and gossips

within this small island. SG CarMart provides me with the latest Car

prices and models. Last year, I also finished

reading SPH published book – “Lee Kuan Yew’s One Man’s View of the World”.

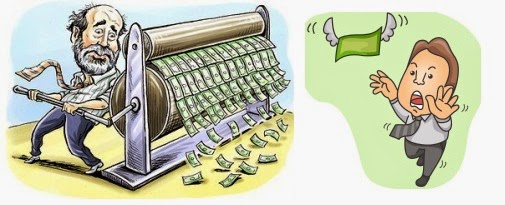

SPH – Not a Money Printer anymore!

Last week, SPH

reported a set of weak 2QFY8/14 results. Revenue was in line, slightly down by

1.3% YoY, due to continually weak media business. The major miss resulted from

higher-than-expected operating costs (+13.7% YoY), attributed to two one-off

charges: a SGD9.9m impairment charge on removal of one of its press lines, and

a SGD10.4m special bonus. This was offset by a SGD52.9m gain on divestment of

701Search, an online classified website, which lifted PATMI by 7.5% YoY.

However, 2QFY8/14 core PATMI collapsed 39.6% QoQ, dragged down by weak top-line

growth (-15.1%). An

reported a set of weak 2QFY8/14 results. Revenue was in line, slightly down by

1.3% YoY, due to continually weak media business. The major miss resulted from

higher-than-expected operating costs (+13.7% YoY), attributed to two one-off

charges: a SGD9.9m impairment charge on removal of one of its press lines, and

a SGD10.4m special bonus. This was offset by a SGD52.9m gain on divestment of

701Search, an online classified website, which lifted PATMI by 7.5% YoY.

However, 2QFY8/14 core PATMI collapsed 39.6% QoQ, dragged down by weak top-line

growth (-15.1%). An

unchanged interim DPS

of SGD0.07 was declared.

of SGD0.07 was declared.

Refer to analyst

report here.

report here.

My Head says….. Good Bye

I kept SPH for more

than 3 years. Yesterday, I bided farewell to it, selling all 8 lots

at S$4.14 without making a profit or loss, with the exception of loss due to transaction

fees incurred and gains from dividends received for the past years.

than 3 years. Yesterday, I bided farewell to it, selling all 8 lots

at S$4.14 without making a profit or loss, with the exception of loss due to transaction

fees incurred and gains from dividends received for the past years.

While I am

disappointed there is no capital gain, I am happy to receive dividends

averaging 6.2% per year – thanks to a special dividend from the listing of SPH

Reits, resulting a dividend totaling 10% last year.

disappointed there is no capital gain, I am happy to receive dividends

averaging 6.2% per year – thanks to a special dividend from the listing of SPH

Reits, resulting a dividend totaling 10% last year.

Overall I am happy

with SPH performance for the past few years, considering I have very limited analytical knowledge back then, and accumulating SPH shares mainly due to its Monopoly newspaper business and variety of common household names.

with SPH performance for the past few years, considering I have very limited analytical knowledge back then, and accumulating SPH shares mainly due to its Monopoly newspaper business and variety of common household names.

Now, I am skeptical

about its future. Aside from having the edge of no competition in newspapers, I see flattish top line considering population is stagnant now plus free

online news’ triumph over paid hardcopies. Bottom line may fall as a consequence of higher staff costs from inflation. SPH REITs will continue to contribute well, but there are better more diversified alternatives available. Another major contributing factor is the need to manage and re-balance my current portfolio.

about its future. Aside from having the edge of no competition in newspapers, I see flattish top line considering population is stagnant now plus free

online news’ triumph over paid hardcopies. Bottom line may fall as a consequence of higher staff costs from inflation. SPH REITs will continue to contribute well, but there are better more diversified alternatives available. Another major contributing factor is the need to manage and re-balance my current portfolio.

Eventually, my “Head” initiates the departure, not even wanting to wait for my 7c dpu

dividend, which I believe is one of the reasons why price still stay at S$4.15 now.

dividend, which I believe is one of the reasons why price still stay at S$4.15 now.

As I read from a writer “many monkeys will start to leave this tree, fruits getting smaller”